"Gold is the money of kings, silver is the money of gentlemen, barter is the money of peasants – but debt is the money of slaves" Norm Franz, “Money and Wealth in the New Millenium”

12 January 2012

SilverDoctors: Consumer Comfort Highest in Six Months?

SilverDoctors: Consumer Comfort Highest in Six Months?: Sterling may be have a great time hanging out in Greece today eating his popcorn watching the Greece 1 year bond pass 400% . Meanwhile we...

Russian Move Against US Called “First Shot” Of World War III

By Sorcha Faal

A grim Ministry of Finance report prepared for Prime Minister Putin is warning today that the decision by Iran to cease taking US Dollars for its oil could very be the “first shot” fired in World War III, and one which Russia will be blamed for by the Obama regime.

According to this report, Iran swiftly countered planed US sanctions against its Central Bank yesterday by announcing that it will no longer accept the US Dollar as payment for its oil shipments to India, Japan and China, and further announced that bilateral trade between itself and Russia will, also, break from the US Dollar for settlement in favor of the Iranian Rial and Russian Rubles.

Euro Collapse Means Flight To Precious Metals For Investors

Posted by David Morgan on January 12, 2012

Tracy Weslosky: Happy New Year, David. It’s our first Currency Countdown for 2012, how are you today?

David Morgan: I’m well, thank you, Tracy.

Tracy Weslosky: Well let’s talk about what’s happening with the Euro. I’d like to start about the bonds and the impact from the collapse of the Euro. Where do you want to begin?

David Morgan: The overall conditions in Euro, in my view and many commentators is the Eurozone continues to deteriorate, and we’re in a situation where you just cannot get this group of individual countries banded together for political purposes on an economic basis that it is equal for everybody. It’s impossible, and the markets are bearing that out. So strength in one area, weakness in another, and that will continue. As the old adage goes, a chain is as strong as its weakest link. The weak links are several.

You’ve got Spain, Italy, Greece, and others, Ireland. And they’re basically in a depression, these countries. And there’s all kinds of people literally in the streets. So even though France might look good today, and Germany might look good today and the last week or so and there’s all kinds of commentary about resolution of problems and the ECB coming to the rescue. In my view it’s a smoke screen; things are deteriorating basically before our eyes.

Tracy Weslosky: Happy New Year, David. It’s our first Currency Countdown for 2012, how are you today?

David Morgan: I’m well, thank you, Tracy.

Tracy Weslosky: Well let’s talk about what’s happening with the Euro. I’d like to start about the bonds and the impact from the collapse of the Euro. Where do you want to begin?

David Morgan: The overall conditions in Euro, in my view and many commentators is the Eurozone continues to deteriorate, and we’re in a situation where you just cannot get this group of individual countries banded together for political purposes on an economic basis that it is equal for everybody. It’s impossible, and the markets are bearing that out. So strength in one area, weakness in another, and that will continue. As the old adage goes, a chain is as strong as its weakest link. The weak links are several.

You’ve got Spain, Italy, Greece, and others, Ireland. And they’re basically in a depression, these countries. And there’s all kinds of people literally in the streets. So even though France might look good today, and Germany might look good today and the last week or so and there’s all kinds of commentary about resolution of problems and the ECB coming to the rescue. In my view it’s a smoke screen; things are deteriorating basically before our eyes.

Gold Is Absolute Money!

By Richard Russell

The following is an excerpt from Richard Russell's Dow Theory Letters

For a decade I have been urging my subscribers to move into gold — either physical bullion or other wise. Now I am at it again: PLEASE MOVE INTO GOLD. Those who think gold has lapsed into a bear market simply do not know what they are talking about. Gold has simply been correcting in an on-going bull market.

This is a time when almost every central bank in the world is grinding out paper currency, grinding it out by the car-load. This is a time when people are searching for safety. People are frightened and confused. Where is the land of safety?

There is only one safe asset on the planet: that safe asset is gold. Uninformed people believe gold is just a commodity. Wrong, gold is absolute money. Gold alone is the world's only completely safe currency. Gold has no counter-party against it, and no central bank has ever found a way to create gold.

The following is an excerpt from Richard Russell's Dow Theory Letters

For a decade I have been urging my subscribers to move into gold — either physical bullion or other wise. Now I am at it again: PLEASE MOVE INTO GOLD. Those who think gold has lapsed into a bear market simply do not know what they are talking about. Gold has simply been correcting in an on-going bull market.

This is a time when almost every central bank in the world is grinding out paper currency, grinding it out by the car-load. This is a time when people are searching for safety. People are frightened and confused. Where is the land of safety?

There is only one safe asset on the planet: that safe asset is gold. Uninformed people believe gold is just a commodity. Wrong, gold is absolute money. Gold alone is the world's only completely safe currency. Gold has no counter-party against it, and no central bank has ever found a way to create gold.

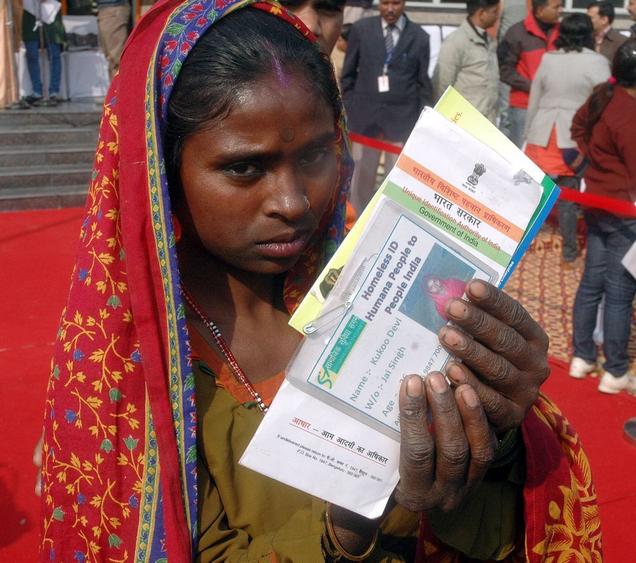

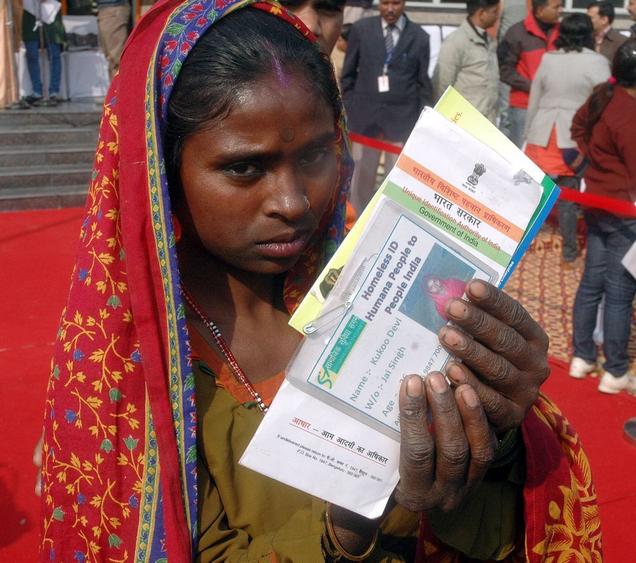

Cashless Society: India Implements First Biometric ID Program for all of its 1.2 Billion Residents

Brandon Turbeville

Infowars.com

January 12, 2012

"Over the past few months, I have written several articles dealing with the coming cashless society and the developing technological control grid. I also have written about the surge of government attempts to gain access to and force the use of biometric data for the purposes of identification, tracking, tracing, and surveillance.<

Unfortunately, the reactions I receive from the general public are almost always the same. While some recognize the danger, most simply deny that governments have the capability or even the desire to create a system in which the population is constantly monitored by virtue of their most private and even biological information. Others, either gripped by apathy or ignorance, cannot believe that the gadgets given to them from the massive tech corporations are designed for anything other than their entertainment and enjoyment."

Infowars.com

January 12, 2012

"Over the past few months, I have written several articles dealing with the coming cashless society and the developing technological control grid. I also have written about the surge of government attempts to gain access to and force the use of biometric data for the purposes of identification, tracking, tracing, and surveillance.<

Unfortunately, the reactions I receive from the general public are almost always the same. While some recognize the danger, most simply deny that governments have the capability or even the desire to create a system in which the population is constantly monitored by virtue of their most private and even biological information. Others, either gripped by apathy or ignorance, cannot believe that the gadgets given to them from the massive tech corporations are designed for anything other than their entertainment and enjoyment."

Central Banks 'Printing Money Like Gangbusters': Gross

By: Margo D. Beller

Special to CNBC.com

Published: Wednesday, 11 Jan 2012 | 5:13 PM ET

The world's central banks are "printing money like gangbusters," which could revive the threat of inflation [cnbc explains] , Pimco founder Bill Gross told CNBC Wednesday.

By putting "hundreds of billions" in currency in circulation, the central banks "can produce reflation—that's why we’re seeing the pop in oil, gold" and other commodities, he said in a live interview.

Special to CNBC.com

Published: Wednesday, 11 Jan 2012 | 5:13 PM ET

The world's central banks are "printing money like gangbusters," which could revive the threat of inflation [cnbc explains] , Pimco founder Bill Gross told CNBC Wednesday.

By putting "hundreds of billions" in currency in circulation, the central banks "can produce reflation—that's why we’re seeing the pop in oil, gold" and other commodities, he said in a live interview.

Etiketter:

Central Bank,

Inflation,

Printing Money,

QE

German exports fall/Rumours of French downgrade/Huge gold imports into China/ ECB deposits of Euros at record levels again.

Wednesday, January 11, 2012

Good evening Ladies and Gentlemen:

Gold closed up by $8.20 to 1639.20. Silver rose by 8 cents to $29.86. Since the gold shares have languished all day today, it is almost a certainty and the bankers will raid tomorrow. I urge you to please to do play with these crooks. There are many facilities available to buy the physical precious metals. The leverage business is now out so the only way you will win is to buy physical gold and silver and be thankful that you paid below the real price of these metals.

Before heading over the comex, the rumours of the street was an imminent French downgrading of their coveted AAA rating:

(courtesy GATA)

"Major banks advising clients that France has been put on 12hr notice regarding its AAA rating"

09:49 French Treasury source says France has not been informed of any imminent decision regarding its credit rating -- Reuters

* There have been rumors, again, that a sovereign rating downgrade for France is coming and today's version of the rumor indicated France had been given 12 hours notice

* €/$ 1.2700

Let us head over to the comex and assess trading, inventory movements and amounts of metal standing for delivery.

The total gold comex rose by 3879 contracts as gold rose by almost $24.00 yesterday. The bankers no doubt supplied much of the paper gold. The front options expiry month of January mysteriously saw its OI rise from 16 to 30 for a gain of 14 contracts despite one delivery notice yesterday. Thus we gained 15 contracts or 1500 oz of gold standing. The next big delivery month is February and here the OI fell from 203,070 to 193,494 as those that needed to roll, did so. The estimated volume today was very low at 125,399. The confirmed volume yesterday was pretty good at 205,864.

The total silver comex OI continues in its narrow channel path. Today the OI rests at 104,345 a drop of exactly 400 contracts from yesterday. The front options expiry month of silver also saw its OI rise from 57 to 83 for a gain of 26 contracts despite a delivery of 42 contracts yesterday. We thus had a huge 68 contract increase in additional silver standing or 340,000 oz. The next big delivery month is March and here the OI fell by around 500 contracts to 56,387. The estimated volume today was a touch higher than normal at 37,257. The confirmed volume yesterday came in at 43,989. The volumes in the silver comex have been noticeably weaker these past several weeks.

Etiketter:

China,

Downgrade,

ECB,

Euro,

Harvey Organ,

import gold

Exclusive Interview – James Turk: “There’s Physical Gold and Paper Gold–The Closer You Are to Physical the Higher the Price”

January 11, 2012 | By Tekoa Da Silva

"On the value of the precious metals and expectations for 2012 James commented, “With regard to gold and silver themselves, I think we’ve seen the low for the year. I think we’re going to clear $2,000oz. on gold before too long and I think $100 silver is quite reasonable. Something over $2,000oz. this year seems likely, and something over $50oz. perhaps as high as $100 per oz. on silver seems to me the most reasonable course...The mining stocks are still on the runway [ready for takeoff]. The runway is this trading range they’ve been in for the last couple years now…Eventually they’re going to break out of these trading ranges to the upside, and they’re going to take off. Hopefully it’s going to be the first quarter of this year because I’m expecting much higher prices on both gold and silver as we work our way to the end of the first quarter.”"

"On the value of the precious metals and expectations for 2012 James commented, “With regard to gold and silver themselves, I think we’ve seen the low for the year. I think we’re going to clear $2,000oz. on gold before too long and I think $100 silver is quite reasonable. Something over $2,000oz. this year seems likely, and something over $50oz. perhaps as high as $100 per oz. on silver seems to me the most reasonable course...The mining stocks are still on the runway [ready for takeoff]. The runway is this trading range they’ve been in for the last couple years now…Eventually they’re going to break out of these trading ranges to the upside, and they’re going to take off. Hopefully it’s going to be the first quarter of this year because I’m expecting much higher prices on both gold and silver as we work our way to the end of the first quarter.”"

Turkey halts Iranian arms corridor to Syria, balks at nuclear Iran

DEBKAfile Exclusive Report January 12, 2012, 10:46 AM (GMT+02:00)

When IDF Military Intelligence chief Maj.-Gen. Aviv Kochavi accused Iran and Hizballah Wednesday, Jan. 11of directly helping Bashar Assad repress the uprising against him with arms, Turkey had just taken a stand against the Iranian corridor running weapons to Syria via its territory, debkafile's military sources report.

Earlier this week, Ankara reported halting five Iranian trucks loaded with weapons for Syria at the Killis Turkish-Syrian border crossing and impounding its freight. According to our intelligence sources, the Iranian convoy was not really stopped at Killis but at the eastern Turkish Dobubayazit border crossing with Iran, near Mount Ararat. This supply route for Syria had been going strong for months. Ankara's decision to suspend it has reduced its volume by 60 percent.

When IDF Military Intelligence chief Maj.-Gen. Aviv Kochavi accused Iran and Hizballah Wednesday, Jan. 11of directly helping Bashar Assad repress the uprising against him with arms, Turkey had just taken a stand against the Iranian corridor running weapons to Syria via its territory, debkafile's military sources report.

Earlier this week, Ankara reported halting five Iranian trucks loaded with weapons for Syria at the Killis Turkish-Syrian border crossing and impounding its freight. According to our intelligence sources, the Iranian convoy was not really stopped at Killis but at the eastern Turkish Dobubayazit border crossing with Iran, near Mount Ararat. This supply route for Syria had been going strong for months. Ankara's decision to suspend it has reduced its volume by 60 percent.

French Resignation to Losing AAA Shifts Focus to Size of Cut: Euro Credit

By Mark Deen - Jan 12, 2012 1:03 PM GMT+0100

After weeks of handwringing about a possible loss of France’s top credit rating, President Nicolas Sarkozy now gives a Gallic shrug.

Investors are interpreting the insouciance -- with Sarkozy saying that losing the AAA rating isn’t “insurmountable” -- to mean that France has accepted the inevitable. The question now is whether Standard & Poor’s will follow through with a threat of a two-level cut.

Sarkozy’s shift, intended to ready voters for the blow ahead of April’s presidential elections, contributed to the increase in the premium France pays over Germany to borrow for 10 years. Since Dec. 5, when S&P said that it may downgrade 15 euro nations amid a deepening regional debt crisis, the spread has widened by 32 percent to 122 basis points.

“They’re preparing the ground for something they see as inevitable,” said Nicola Marinelli, who manages $150 million at Glendevon King Asset Management in London. “The market is expecting France to be a strong AA; expecting it to be AA+. If any rating change goes lower than that the spread with Germany can widen further.”

France, Europe’s second-largest economy and the No. 2 backer of the region’s rescue fund after Germany, was singled out among the six euro-region holders of the top AAA rating by S&P as the one that risked a two-level lowering of its credit rating. The country’s downgrade would affect the rating of the European Financial Stability Fund, making the bailout of the region’s troubled economies more expensive.

After weeks of handwringing about a possible loss of France’s top credit rating, President Nicolas Sarkozy now gives a Gallic shrug.

Investors are interpreting the insouciance -- with Sarkozy saying that losing the AAA rating isn’t “insurmountable” -- to mean that France has accepted the inevitable. The question now is whether Standard & Poor’s will follow through with a threat of a two-level cut.

Sarkozy’s shift, intended to ready voters for the blow ahead of April’s presidential elections, contributed to the increase in the premium France pays over Germany to borrow for 10 years. Since Dec. 5, when S&P said that it may downgrade 15 euro nations amid a deepening regional debt crisis, the spread has widened by 32 percent to 122 basis points.

“They’re preparing the ground for something they see as inevitable,” said Nicola Marinelli, who manages $150 million at Glendevon King Asset Management in London. “The market is expecting France to be a strong AA; expecting it to be AA+. If any rating change goes lower than that the spread with Germany can widen further.”

France, Europe’s second-largest economy and the No. 2 backer of the region’s rescue fund after Germany, was singled out among the six euro-region holders of the top AAA rating by S&P as the one that risked a two-level lowering of its credit rating. The country’s downgrade would affect the rating of the European Financial Stability Fund, making the bailout of the region’s troubled economies more expensive.

China Gets Cheaper Iran Oil

By Indira A.R. Lakshmanan and Gopal Ratnam - Jan 12, 2012 4:20 AM GMT+0100

China stands to be the biggest beneficiary of U.S. and European plans for sanctions on Iran’s oil sales in an effort to pressure the regime to abandon its nuclear program.

As European Union members negotiate an Iranian oil embargo and the U.S. begins work on imposing sanctions to complicate global payments for Iranian oil, Chinese refiners already may be taking advantage of the mounting pressure. China is demanding discounts and better terms on Iranian crude, oil analysts and sanctions advocates said in interviews.

“The sanctions against Iran strengthen the Chinese hand at the negotiating table,” Michael Wittner, head of oil-market research for Societe Generale SA in New York, said in a phone interview. Chinese refiners are likely to win discounts on Iranian crude contracts as buyers from other nations halt or reduce their purchases of Iranian oil to avoid being penalized by U.S. and European sanctions, he said.

China stands to be the biggest beneficiary of U.S. and European plans for sanctions on Iran’s oil sales in an effort to pressure the regime to abandon its nuclear program.

As European Union members negotiate an Iranian oil embargo and the U.S. begins work on imposing sanctions to complicate global payments for Iranian oil, Chinese refiners already may be taking advantage of the mounting pressure. China is demanding discounts and better terms on Iranian crude, oil analysts and sanctions advocates said in interviews.

“The sanctions against Iran strengthen the Chinese hand at the negotiating table,” Michael Wittner, head of oil-market research for Societe Generale SA in New York, said in a phone interview. Chinese refiners are likely to win discounts on Iranian crude contracts as buyers from other nations halt or reduce their purchases of Iranian oil to avoid being penalized by U.S. and European sanctions, he said.

Abu Dhabi Islamic Bank introduces Capital Protected Gold Notes

Source: BI-ME , Author: Posted by BI-ME staff

Posted: Thu January 12, 2012 12:46 pm

UAE. As part of Abu Dhabi Islamic Bank’s (ADIB) customer-centric strategy to present customized and targeted products and services, the bank today announced the launch of its Capital Protected Gold Notes that can be combined with a selection of mutual funds.

Depending on the risk tolerance and profile of investors, they can choose one of three investment options. The 80% Capital Protected Gold Note, the 98% Capital Protected Gold Note or the combination of the 98% Gold Note with selected mutual funds. Investors have the option of investing in whichever note best suits their risk tolerance and investment objectives.

Posted: Thu January 12, 2012 12:46 pm

UAE. As part of Abu Dhabi Islamic Bank’s (ADIB) customer-centric strategy to present customized and targeted products and services, the bank today announced the launch of its Capital Protected Gold Notes that can be combined with a selection of mutual funds.

Depending on the risk tolerance and profile of investors, they can choose one of three investment options. The 80% Capital Protected Gold Note, the 98% Capital Protected Gold Note or the combination of the 98% Gold Note with selected mutual funds. Investors have the option of investing in whichever note best suits their risk tolerance and investment objectives.

Gold jumps above $1,650 uncertainty continues to cap gains

Author: Jan Harvey (Reuters)

Posted: Thursday , 12 Jan 2012

While a stronger euro, on the back of a successful Spanish bond sale, helped boost the yellow metal, an upcoming ECB interest rate decision curbed investor enthusiasm

Posted: Thursday , 12 Jan 2012

While a stronger euro, on the back of a successful Spanish bond sale, helped boost the yellow metal, an upcoming ECB interest rate decision curbed investor enthusiasm

BofA Is Suing A Florida Couple Over A Mortgage Typo They Never Even Made

Mandi Woodruff | Jan. 12, 2012, 11:14 AM

For an institution that's had its fair share of PR pitfalls, Bank of America certainly hasn't been doing itself any favors lately.

Now a Bloomington, Fla. couple is crying foul over the lender's decision to sue them over a home they purchased – in full – nearly a decade before.

Barbara and Rick Borchers told Tampa Bay Online they thought it was somebody's idea of a joke when they were served with the lawsuit.

"Everyone I tell says, 'That's impossible, it's a scam, somebody is pulling your leg,'" Barbara Borchers said.

But Bank of America wasn't kidding around. It turns out an error made by the title company the couple hired to close the sale back in 2003 was blocking it from foreclosing on the current owner.

For an institution that's had its fair share of PR pitfalls, Bank of America certainly hasn't been doing itself any favors lately.

Now a Bloomington, Fla. couple is crying foul over the lender's decision to sue them over a home they purchased – in full – nearly a decade before.

Barbara and Rick Borchers told Tampa Bay Online they thought it was somebody's idea of a joke when they were served with the lawsuit.

"Everyone I tell says, 'That's impossible, it's a scam, somebody is pulling your leg,'" Barbara Borchers said.

But Bank of America wasn't kidding around. It turns out an error made by the title company the couple hired to close the sale back in 2003 was blocking it from foreclosing on the current owner.

Gold Price: Beware! Government Spooks Infest Gold Market

Posted by Dominique de Kevelioc de Bailleul on Jan 11, 2012

Today’s revelation of China’s surge in gold imports in the month of November from its principal gold dealer, Hong Kong, exposes Western financial media for the umpteenth time for its blatant propaganda (at the behest of central bankers) against one of the only assets that will protect wealth during these most turbulent times. Sign-up for my 100% FREE Alerts

“Mainland China’s imports from Hong Kong surged to 102,779kg/oz from 86,299kg/oz in October,” stated bullion advisory group, GoldCore. “This is a 20% increase from the already high number seen in October and a 483% y/y increase.”

See zerohedge.com for the full article from GoldCore.

Note: see the staggering trend of Beijing gold purchases in the Reuter’s chart, below, halfway through the article.

While a media blitz campaign waged against the gold market kicks into full gear, the Chinese buy tons.

And let’s not forget India, the country that, last year, bought more gold than Switzerland claims it stores with the SNB, which is approximately 1,000 tons.

“Gold traders in India, the world’s biggest buyer of bullion, stepped up buying for the upcoming wedding season, as gold prices stayed near the week’s trough, giving silver a boost,” India’s Economic Times stated on Jan. 11.

The two largest bulk buyers of gold are stepping up with increasingly larger orders as the spot price retreats, but the U.S. and UK media tell readers the gold bull market is over—or that gold should be seriously questioned as to its validity for wealth protection during the biggest financial crisis since the 1930s.

Today’s revelation of China’s surge in gold imports in the month of November from its principal gold dealer, Hong Kong, exposes Western financial media for the umpteenth time for its blatant propaganda (at the behest of central bankers) against one of the only assets that will protect wealth during these most turbulent times. Sign-up for my 100% FREE Alerts

“Mainland China’s imports from Hong Kong surged to 102,779kg/oz from 86,299kg/oz in October,” stated bullion advisory group, GoldCore. “This is a 20% increase from the already high number seen in October and a 483% y/y increase.”

See zerohedge.com for the full article from GoldCore.

Note: see the staggering trend of Beijing gold purchases in the Reuter’s chart, below, halfway through the article.

While a media blitz campaign waged against the gold market kicks into full gear, the Chinese buy tons.

And let’s not forget India, the country that, last year, bought more gold than Switzerland claims it stores with the SNB, which is approximately 1,000 tons.

“Gold traders in India, the world’s biggest buyer of bullion, stepped up buying for the upcoming wedding season, as gold prices stayed near the week’s trough, giving silver a boost,” India’s Economic Times stated on Jan. 11.

The two largest bulk buyers of gold are stepping up with increasingly larger orders as the spot price retreats, but the U.S. and UK media tell readers the gold bull market is over—or that gold should be seriously questioned as to its validity for wealth protection during the biggest financial crisis since the 1930s.

Silver Coin Sales May Signal Bear-Market End: Chart of the Day

By Maria Kolesnikova

Jan. 12 (Bloomberg) -- The surge in the U.S. Mint’s sales of American Eagle silver coins in January may signal an end to the bear market in the metal.

The CHART OF THE DAY shows the Mint sold 4.26 million ounces of the coins to authorized purchasers Jan. 3 through Jan. 10. At this pace, full-month deliveries may reach 14.2 million ounces, more than twice the record 6.422 million ounces sold in January 2011.

Silver futures fell 48 percent from April to December, more than double the 20 percent drop associated with the start of a bear market. Prices are up 6.9 percent this year. Silver may rise as high as $42.20 an ounce this year, according to the median of 41 analyst estimates in a Bloomberg survey last month.

Jan. 12 (Bloomberg) -- The surge in the U.S. Mint’s sales of American Eagle silver coins in January may signal an end to the bear market in the metal.

The CHART OF THE DAY shows the Mint sold 4.26 million ounces of the coins to authorized purchasers Jan. 3 through Jan. 10. At this pace, full-month deliveries may reach 14.2 million ounces, more than twice the record 6.422 million ounces sold in January 2011.

Silver futures fell 48 percent from April to December, more than double the 20 percent drop associated with the start of a bear market. Prices are up 6.9 percent this year. Silver may rise as high as $42.20 an ounce this year, according to the median of 41 analyst estimates in a Bloomberg survey last month.

Gold extends gains after ECB, lower dollar

By Claudia Assis and Virginia Harrison, MarketWatch

SAN FRANCISCO (MarketWatch) — Gold futures rose Thursday, on track for a third session of gains as a trickle of safe-haven flows returned to the market after the European Central Bank warned of “substantial” downside risks for the euro zone’s outlook and the dollar traded lower.

SAN FRANCISCO (MarketWatch) — Gold futures rose Thursday, on track for a third session of gains as a trickle of safe-haven flows returned to the market after the European Central Bank warned of “substantial” downside risks for the euro zone’s outlook and the dollar traded lower.

U.S. Mint Eagle Gold Coins May Pace Silver Sales, Dealer Says

By Maria Kolesnikova - Jan 12, 2012 8:49 AM GMT+0100

The U.S. Mint’s sales of American Eagle gold coins may keep pace with silver coins later this year, according to Dillon Gage Metals, one of 11 dealers authorized to purchase silver coins in the U.S. directly from the mint.

Following are comments from Terry Hanlon, president of the Addison, Texas-based company. He commented in a phone interview Jan. 10.

On silver and gold coins sales:

“Silver always gets more attention than gold at the beginning of the year. Those are coins that have had problems with allocations, more so than gold. The U.S. Mint has always geared up to provide enough gold.

The U.S. Mint’s sales of American Eagle gold coins may keep pace with silver coins later this year, according to Dillon Gage Metals, one of 11 dealers authorized to purchase silver coins in the U.S. directly from the mint.

Following are comments from Terry Hanlon, president of the Addison, Texas-based company. He commented in a phone interview Jan. 10.

On silver and gold coins sales:

“Silver always gets more attention than gold at the beginning of the year. Those are coins that have had problems with allocations, more so than gold. The U.S. Mint has always geared up to provide enough gold.

Etiketter:

silver,

silver coin,

silver eagles,

us mint

Gold rises as ECB comments lift euro

By Jan Harvey

LONDON | Thu Jan 12, 2012 10:14am EST

(Reuters) - Gold climbed towards $1,660 an ounce on Thursday after European Central Bank president Mario Draghi said the supply of cheap money released by the bank was helping stabilize the banking system and lift the euro zone economy, boosting the euro.

LONDON | Thu Jan 12, 2012 10:14am EST

(Reuters) - Gold climbed towards $1,660 an ounce on Thursday after European Central Bank president Mario Draghi said the supply of cheap money released by the bank was helping stabilize the banking system and lift the euro zone economy, boosting the euro.

Fractal Analysis Suggests Massive Gold Rally Is Coming

By Hubert Moolman

Below, is a gold alert sent to my premium subscribers, on 5 January 2012. The patterns indicated, suggest that we will have a massive rally in gold over the coming months.

Below, is a graphic that compares the gold chart from 1998 to present, to that of 1975 to 1979.

Below, is a gold alert sent to my premium subscribers, on 5 January 2012. The patterns indicated, suggest that we will have a massive rally in gold over the coming months.

Below, is a graphic that compares the gold chart from 1998 to present, to that of 1975 to 1979.

Has the Central Fund of Canada Given Us Another Silver Buy Signal?

Adam Brochert

|

January 12, 2012 - 7:16am

"I stumbled onto this little gem about a year ago and I think it is about to work its magic again. I am speaking of the ratio of the Central Fund of Canada (CEF) to the price of Gold. Please see the original blog post for an explanation of this CEF:Gold ratio.

This CEF:Gold ratio barely triggered a buy signal for silver on December 27, 2011. Of course, a "barely triggered" signal may be all we are able to achieve if silver is getting ready to rocket higher after a brutal but fairly typical (for silver) correction from the the spring, 2011 highs. Here's a chart of this ratio thru today's close to show the buy signal for silver (the top plot is the price of silver, while the lower plot is the CEF:$GOLD ratio):"

|

January 12, 2012 - 7:16am

"I stumbled onto this little gem about a year ago and I think it is about to work its magic again. I am speaking of the ratio of the Central Fund of Canada (CEF) to the price of Gold. Please see the original blog post for an explanation of this CEF:Gold ratio.

This CEF:Gold ratio barely triggered a buy signal for silver on December 27, 2011. Of course, a "barely triggered" signal may be all we are able to achieve if silver is getting ready to rocket higher after a brutal but fairly typical (for silver) correction from the the spring, 2011 highs. Here's a chart of this ratio thru today's close to show the buy signal for silver (the top plot is the price of silver, while the lower plot is the CEF:$GOLD ratio):"

Gold Correction Is Over

By: Alf Field

There is a strong probability that the correction in the price of gold has been completed. This article has four separate sections. They are:

1. The Elliott Wave (EW) justification for thinking that the correction in gold is over.

2. Why corrections happen in gold from a fundamental viewpoint.

3. The extent to which manipulation affects the gold price.

4. A possible “black swan” event that could trigger a gold price surge.

There is a strong probability that the correction in the price of gold has been completed. This article has four separate sections. They are:

1. The Elliott Wave (EW) justification for thinking that the correction in gold is over.

2. Why corrections happen in gold from a fundamental viewpoint.

3. The extent to which manipulation affects the gold price.

4. A possible “black swan” event that could trigger a gold price surge.

Gold & silver: Creating the right exit strategy

As we climb the wall of fear in this present Gold and Silver bull market, weak hands are constantly calling tops, even though the kettle has not really started to boil. GI Metals DMCC views that there will be no need to think about getting out of this particular asset class and into another more undervalued one, until two things occur.

Firstly, the general public needs to be getting into gold and silver en-masse, and secondly, the end-game of the current fiat/debt crisis needs to commence in truth: the end-game is the collapse of the world reserve currency. Although this has been occurring slowly over the last century, in order for there to be a mad rush into gold and silver driven by fear and greed, there must also be a pronounced loss of confidence in the American dollar. That is what will turn gold and silver from being the excellent hedge and cultivator of wealth it has been over the last decade to being virtually the only place to be; for a time.

When this period of great fear and greed occurs, it will be time for wise investors to consider moving a good portion of their wealth from gold and silver into other more undervalued asset classes. This article will discuss the strategy which we feel is best for precious metals holders to use in the coming months and years.

Firstly, the general public needs to be getting into gold and silver en-masse, and secondly, the end-game of the current fiat/debt crisis needs to commence in truth: the end-game is the collapse of the world reserve currency. Although this has been occurring slowly over the last century, in order for there to be a mad rush into gold and silver driven by fear and greed, there must also be a pronounced loss of confidence in the American dollar. That is what will turn gold and silver from being the excellent hedge and cultivator of wealth it has been over the last decade to being virtually the only place to be; for a time.

When this period of great fear and greed occurs, it will be time for wise investors to consider moving a good portion of their wealth from gold and silver into other more undervalued asset classes. This article will discuss the strategy which we feel is best for precious metals holders to use in the coming months and years.

Iraqi Central Bank: Reasons why to increase gold reserves

Finansial reasons to increase Gold reserves

--Central bank as well as investors have lost their faith in currency markets after the turmoil in the USA in 2008 and Europe in 2011. The USA and some of the European countries have a huge trade deficit and are bound to grow at a very slow rate. The USA has a debt of nearly $15 trillion and a current account deficit of over $110 billion. Near zero interest rates have so far been ineffective. Even flooding the markets with free money by the Federal Reserve, the Bank of England and the European central bank has failed. The Federal Reserve has said in 2011 it will protect large US corporations from failing in the future. In 2008 they conceptualized the concept of “too big to fail” for USA banks and financial corporations. Europe, USA and the UK, all the champions of capitalism and capitalism based democracy, are resorting to protectionism in some form or the other.

--When any concern (banks or anyone) knows that it will be rescued by their government in the event it nears bankruptcy, their managers, CEO, CFO and other executives working there, will take unlimited risk fearlessly. This is the message sent by the Federal Reserve as well as European central banks (among other nations) to entrepreneurs of their nations. Take as much risk as you can if you can succeed in higher short term growth and employment, as in case of a bust we are there to protect you. This has not gone down well with emerging markets and other countries where there is a call to open their economy while protectionism is being followed by the callers.

--Central bank as well as investors have lost their faith in currency markets after the turmoil in the USA in 2008 and Europe in 2011. The USA and some of the European countries have a huge trade deficit and are bound to grow at a very slow rate. The USA has a debt of nearly $15 trillion and a current account deficit of over $110 billion. Near zero interest rates have so far been ineffective. Even flooding the markets with free money by the Federal Reserve, the Bank of England and the European central bank has failed. The Federal Reserve has said in 2011 it will protect large US corporations from failing in the future. In 2008 they conceptualized the concept of “too big to fail” for USA banks and financial corporations. Europe, USA and the UK, all the champions of capitalism and capitalism based democracy, are resorting to protectionism in some form or the other.

--When any concern (banks or anyone) knows that it will be rescued by their government in the event it nears bankruptcy, their managers, CEO, CFO and other executives working there, will take unlimited risk fearlessly. This is the message sent by the Federal Reserve as well as European central banks (among other nations) to entrepreneurs of their nations. Take as much risk as you can if you can succeed in higher short term growth and employment, as in case of a bust we are there to protect you. This has not gone down well with emerging markets and other countries where there is a call to open their economy while protectionism is being followed by the callers.

Gold: Is the Chinese central bank behind the 483% surge in November imports?

Gold Core

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for Gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.

Mainland China's imports from Hong Kong surged to 102,779kg/oz in November from 86,299kg/oz in October. This is a 20% increase from the already high number seen in October and a 483% y/y increase.

The run into Chinese Lunar New Year has again seen higher than expected Chinese demand for Gold and China's voracious appetite for gold is surprising even analysts who are positive about gold.

Mainland China's imports from Hong Kong surged to 102,779kg/oz in November from 86,299kg/oz in October. This is a 20% increase from the already high number seen in October and a 483% y/y increase.

What the 11 year Gold rally and its corrections teach us

NEW YORK (Commodity Online): Right now you need to understand that Gold is beginning the twelfth year of major bull market; perhaps the most unprecedented bull market in our lifetime. Here's a quick snapshot of what that bull market has looked like since the 1999 bottom and the 2001 retest of that bottom:

2012 gold panic in China?

By Adrian Ash

China's latest Gold figures look unrelentingly bullish. Too bullish perhaps...

So "Growth has [now] replaced inflation as Beijing's top policy concern," says Qu Hongbin, Asian economics expert at HSBC in Hong Kong, forecasting three cuts to China's banking reserve requirements by July.

"There is developing in Beijing, I think, almost a panic about global economic prospects and the impact of the European crisis on China," agrees Michael Pettis, finance professor at Peking University. He goes one further and forecasts debate - if not the fact - of a currency devaluation in 2012.

Yes, you read that right. In a US election year, Beijing's policy wonks are arguing over cutting the Yuan's foreign exchange value, not raising it.

China's latest Gold figures look unrelentingly bullish. Too bullish perhaps...

So "Growth has [now] replaced inflation as Beijing's top policy concern," says Qu Hongbin, Asian economics expert at HSBC in Hong Kong, forecasting three cuts to China's banking reserve requirements by July.

"There is developing in Beijing, I think, almost a panic about global economic prospects and the impact of the European crisis on China," agrees Michael Pettis, finance professor at Peking University. He goes one further and forecasts debate - if not the fact - of a currency devaluation in 2012.

Yes, you read that right. In a US election year, Beijing's policy wonks are arguing over cutting the Yuan's foreign exchange value, not raising it.

Fed Dismisses Economic Recovery

by Michael Pento - Pento Portfolio Strategies

Published : January 12th, 2012

The Fed is becoming more concerned about the sustainability of the U.S. recovery, just as the economy looks to be gaining momentum. The unemployment rate has dropped from 9.4% in December of 2010, to 8.5% twelve months later. The American economy has added 1.5 million jobs over the past year, according to the establishment survey of employment, while the household survey shows we have averaged a monthly gain of 230,000 jobs over the past six months. Meanwhile, the average work week and hourly earnings also showed improvement in the December Nonfarm payroll report. In addition, Gross Domestic Product has increased for nine consecutive quarters and is anticipated to post just under a 3% annualized growth in Q4 2011, up from 1.8% during the prior quarter.

So what was the Fed's reaction to this ostensibly better news? San Francisco Fed president John Williams told the WSJ in an interview conducted after the December's NFP report release that the central bank will have to buy more mortgage related bonds and that interest rates would not increase for a very long time. Here is his quote, "Unemployment is going to be sustained above a reasonable estimate of the natural rate of unemployment, which is closer to 6.5 percent than the 8.5 percent that we have now. That does make an argument that we should have more stimulus."

Published : January 12th, 2012

The Fed is becoming more concerned about the sustainability of the U.S. recovery, just as the economy looks to be gaining momentum. The unemployment rate has dropped from 9.4% in December of 2010, to 8.5% twelve months later. The American economy has added 1.5 million jobs over the past year, according to the establishment survey of employment, while the household survey shows we have averaged a monthly gain of 230,000 jobs over the past six months. Meanwhile, the average work week and hourly earnings also showed improvement in the December Nonfarm payroll report. In addition, Gross Domestic Product has increased for nine consecutive quarters and is anticipated to post just under a 3% annualized growth in Q4 2011, up from 1.8% during the prior quarter.

So what was the Fed's reaction to this ostensibly better news? San Francisco Fed president John Williams told the WSJ in an interview conducted after the December's NFP report release that the central bank will have to buy more mortgage related bonds and that interest rates would not increase for a very long time. Here is his quote, "Unemployment is going to be sustained above a reasonable estimate of the natural rate of unemployment, which is closer to 6.5 percent than the 8.5 percent that we have now. That does make an argument that we should have more stimulus."

SilverDoctors: Greek Parents Dumping "Unaffordable" Children in t...

SilverDoctors: Greek Parents Dumping "Unaffordable" Children in t...: The US is Greece x 100. Greek parents are abandoning their children on the streets because they cannot afford them due to the Greek debt cr...

Gold/Silver Price Ratio Getting Silly Again

Written by Jeff Nielson Monday, 09 January 2012 13:26

Arithmetic is a harsh mistress. Irrespective of how badly the banking cabal wishes to suppress the prices of gold and silver, and irrespective of how much brute force they are able to apply to the market over the short term with their (illegal) manipulations; the inexorable pull of supply and demand will inevitably overwhelm any/all such operations.

This is not the whimsical theory of some ivory-tower economist, but a simple fact of markets which has been demonstrated to us all in totally unequivocal parameters. Thus back in the “bad, old days” of manipulation – when the banksters still had large hoards of bullion to dump onto the market and crush the price – the price of silver was pushed to a 600-year low (in real dollars). What did the extreme manipulation of the silver market in the 1990’s reap for the banksters? A 1,000% increase in the price of silver over the following decade.

The misunderstanding of most novice investors in this sector (and a source of tremendous frustration) is that these short-term episodes of manipulation somehow delay (or even prevent) gold and silver prices from reaching their “maximum” levels. In fact the precise opposite is the truth: each and every manipulation operation translates to even higher long-term prices for gold and silver. It’s all just simple arithmetic.

SilverDoctors: ECB Holds Rates at 1.0%

SilverDoctors: ECB Holds Rates at 1.0%: The European Central Bank left interest rates on hold on Thursday, pausing to assess the impact of back-to-back cuts and a slew of other m...

SilverDoctors: Gold and Silver Holding on to Overnight Gains

SilverDoctors: Gold and Silver Holding on to Overnight Gains: Gold and silver are holding onto marginal gains of 1.5% for silver and 0.7% for gold. Europe maintained rates at 1% which was in line with ...

SilverDoctors: ECB Press Conference Going on Now

SilverDoctors: ECB Press Conference Going on Now: Rate decision was unanimous. Zerohedge is broadcasting the conference live. We are working to get this up here on SilverDoctors. http://w...

SilverDoctors: Greek 1 Year Bond Passes 400%

SilverDoctors: Greek 1 Year Bond Passes 400%: Greek's 1 year bond yield has just passed 400%, touching 403.34%!!! As we have mentioned numerous times previously, the US is Greece x 100....

SilverDoctors: U.S. Inquiry of MF Global Gains Speed

SilverDoctors: U.S. Inquiry of MF Global Gains Speed: The mid level MF Global exec the big-wigs planned on throwing under the bus in the MF Global missing client segregated funds scandal must ha...

SilverDoctors: Top German PM Dealer Restricts Gold & Silver Shipm...

SilverDoctors: Top German PM Dealer Restricts Gold & Silver Shipm...: Several days ago we advised readers that Italy has introduced capital controls, outlawing cash purchases over 1,000 euros, as well as settin...

Etiketter:

Germany,

gold,

Italy,

Precious Metals,

silver,

silver doctors

Subscribe to:

Posts (Atom)