By: Bix Weir

Is There Silver Price Manipulation?

Let's start with a question. What should the silver market look like? In the broad scope of markets the silver market is relatively tiny. In my opinion it should be a sleepy "quaint" little market. Supply is fairly stable varying about 5% annually. There are never any huge silver discovery announcements. Silver is mostly mined as a byproduct of mining for other metals. There's only a hand full of dedicated silver mining companies. Industrial demand is fairly constant over the years. Investment demand is growing but official numbers aren't that huge.

You'd think that in a market like this the miners and silver buyers could easily come together and transact business discovering the "Fair Market Value" of silver.

The Silver market should be a "QUAINT LITTLE MARKET".

But the reality is much different…

1) Massive Volatility -- The silver market is characterized by larges upward moves over time with huge and sudden downward slams. There are massive volumes traded back and forth. Fortunes are made and lost. There's blood in the streets after each market slam. In 2008 the price dropped from $21 to below $9 in a matter of months. On May 1st silver was violently slammed down from $50 to $35 in a matter days. It was called a "Drive By Shooting" by many in the silver investment community. There is an insane amount of volatility. The Silver market is no place for you to invest if you have a weak stomach.

2) Off hours trading - Most of the downward volatility begins in the off hours of trading before or after the large markets are open. The May 1st "Drive-By-Shooting" started in the middle of the night on a Sunday and dropped 10% instantly…who trades like that? If you had a huge long position in silver that you wanted to unload would you do it in the afterhours market to maximize your price? There was no news to spook the market. This was a blatant manipulation and was obvious to all of us.

3) COMEX Short Concentration -- Ted Butler has been exposing the Short concentration issue for 20 years and we all know of his work. The kicker for me was that in November 2009 (2) traders or less (likely 1) held 68% of the Commercial Net Short. 68% of the short was held by one trader! The CFTC has just passed the Position Limits rule and hopefully this will put an end to the excessive short concentration in the future but we'll see.

4) Multiple Ownership Claims -- Who owns the physical silver these days? With so many silver derivatives there are many options for bullion banks and others to work a Fractional Reserve metal storage system. Silver certificates, swaps, leases pooled accounts, options, ETF shorting and on and on. In 2007 Morgan Stanley was sued for charging storage fees on silver certificates although they didn't hold the physical silver in inventory. It was settled out of court but their defense was that the practice of selling silver certificates and not holding the physical metal was "Industry Standard Practice". What about the silver iShares ETF? How many claims of ownership are on that silver? It's unknown but we do know that there are 20M shares short at the moment. There are currently investors in SLV who bought 20M shares expecting the ETF to deposit 20M ounces in inventory but that metal was shorted instead of placed in inventory.

5) Exchange Margin Requirements -- The latest silver slam was assisted by huge margin requirement increases by the CME to squeeze the weak handed shorts. This was a blatant manipulative move by the CME and it added significantly to the downward plunge in the price of silver…which is illegal by the way. Craig Donahue, the CEO of the CME, had to come on TV to try and justify their actions. He said "Margin requirements are really intended to make sure that we have the ability to PROTECT all participants in the clearing house because WE ARE THE GUARANTOR to every buyer and seller." So margins were increased to PROTECT market participants. At $50/oz who needed protection? Clearly the longs didn't need protection. It was the shorts that were being protected from default because they sold silver derivatives on metal they didn't have. Get out of the COMEX. If you play in their market you play by their rules!

6) 3rd CFTC Silver Investigation -- First two silver investigations were a joke. They were announced and closed at the same time with no finding of manipulation. The CFTC's main conclusions were that the price was going up so there can't be downward manipulation and the London Bullion Market was a "physical market" and is in line with the COMEX. Give me a break. The LBM will settle 50B ounce of supposedly physical silver this year! There's nothing physical about that market.

7) Whistle Blowers -- Ok. We've finally arrived at that SILVER BULLET to put an end to the manipulation once and for all. We have a whistle blower. Andrew Maguire. I'll say it again Andrew Maguire. It's strange but I keep thinking of that movie Jerry Maguire when I hear his name? I think if comes from a drinking game in college where we had to drink every time we heard his name in the movie…which is a lot. Now every time I hear Jeffrey Christian or Jon Nadler saying there's no silver market manipulation I hear in my head…Andrew Maguire, Andrew Maguire. Yes, the Andrew Maguire revelations at the CFTC meeting in March of 2010 was the smoking gun to END the silver manipulation debate. He told the CFTC who was doing it, why they were doing it, how they were doing it, when they were going to do it next and it happened just like he said. Case closed. I'm sure Bill Murphy will elaborate on this tomorrow.

But there was another very important whistle blower inside of the CFTC itself. CFTC Enforcement Judge George Painter said in his retirement letter…"There are two administrative law judges at the CFTC, myself and the Honorable Judge Bruce Levine. On Judge Levine's first week on the job, nearly twenty years ago, he came into my office and stated that he had promised Wendy Gramm, then Chairwoman of the Commission, that we would never rule in a complainant's favor. A review of his rulings will confirm that he has fulfilled his vow."

8) YES there is Manipulation - As we all expected. The game is rigged. From the regulators to the bullion banks to the exchanges to our elected officials our "Quaint Little Silver Market" is 100% rigged.

So now that we know the silver market is rigged the next logical question is…

"How Do They Do It"?

The tools of manipulation are:

MORE

Andrew Maguire finally exposes systemic fraud by CFTC & JPMorgan

Ted Butler: Criminal Silver Manipulation

SBSS. 18 Silver Manipulation Part 1

SBSS 19. Silver Manipulation Part 2

The Who, How, and Why Behind Silver Price Manipulation

APRIL 6, 2012

BY PETER KRAUTH, Global Resources Specialist, Money Morning

No one knows the machinations of the day-to-day silver price better than Ted Butler.

Ted publishes bi-weekly commentary at www.butlerresearch.com, with a special focus on the silver market, which he's been closely following for over 30 years. Ted is an expert's expert.

So naturally, that's whom I turned to for an in-depth perspective on what's really going on with the silver price. As usual, Ted tells it like it is.

I think you'll be fascinated by Ted's tremendous insights...

Ted Butler on Silver Price Manipulation

Ted, you're widely recognized as the foremost expert on manipulation in the silver futures market. How do you define manipulation, and how are the main players benefiting from that?

Manipulation is another way of saying someone controls and dominates the market by means of an excessively large position. So, just by holding such a large concentrated position, the manipulation is largely explained. In real terms, whenever a single entity or a few entities come to dominate a market, all sorts of alarms should be sounded. This is at the heart of U.S. antitrust law. It is no different under commodity law.

Price manipulation is the most serious market crime possible under commodity law. In fact, there is a simple and effective and time-proven antidote to manipulation that has existed for almost a century, and that solution is speculative position limits. Currently, the Commodities Futures Trading Commission

(CFTC) is attempting to institute position limits in silver, but the big banks are fighting it tooth and nail.

As far as any benefits the manipulators may reap, it varies with each entity. But if you dominate and control a market by means of a large concentrated position, you can put the price wherever you desire at times, and that's exactly what the silver manipulators do regularly. This explains why we have such wicked sell-offs in silver; because the big shorts pull all sorts of dirty market tricks to send the price lower.

Could you tell us when and how you got started researching this matter?

It started around 1985, when a brokerage client asked me to explain how silver could remain so low in price (in the single digits) when the world was consuming more metal than was being produced. I accepted the intellectual challenge, and it took me more than a year to figure out that the paper short positions on the COMEX were so large as to constitute an almost unlimited supply. It was this paper supply that was depressing the price.

Who are the main players in this manipulation scheme? On average, what percentage of COMEX silver contracts are "controlled" by these main players?

Under U.S. commodity law, the names of individual traders are kept confidential. However, it is no secret that the commercial traders are the big shorts. It is also no secret that these big commercial shorts are mostly money center banks and financial institutions. Based upon government data and correspondence, the largest such short almost certainly is JPMorgan Chase & Co. (NYSE: JPM), who inherited their big silver short position from Bear Stearns when JPM took over that firm in 2008.

Together, the eight largest commercial silver shorts on the COMEX generally account for 50% to 60% of the entire net COMEX silver market, with JPMorgan alone holding around 25% or more of the entire market. I would hold that those percentages of concentration and control constitute manipulation, in and of themselves. By the way, there is no comparable concentration on the long side; only the short side of silver.

What exactly are the dominant players doing to manipulate the price?

The current exact mechanism they use to suddenly rig the price lower is High Frequency Trading (HFT). This is the placing of sell orders in great quantities by computer programs that suddenly appear as legitimate orders, but are really mostly "spoofs," or orders entered and canceled immediately (in the fractions of a second). When the sell orders first appear, they spook others into selling as they give the appearance of great selling about to hit the market. Instead, it is all a bluff, intended only to scare others into selling, as the vast majority of these original sell orders are never executed, nor were they ever intended to be executed. They were designed for one purpose only - to scare others into selling.

Through HFT, the commercials are able to push prices suddenly lower on very little actual volume. But once prices are put lower, the outside selling (from those who are frightened by the drop in prices) hits the market. It is that outside selling from technical traders that the commercials then buy. In a nutshell that's the HFT scam in silver. It is important to grasp the fact that the actual selling (and commercial buying) takes place AFTER the price drops. Most people think great selling is what causes the price to decline, but that's not true. The great selling only comes in after the price has been put lower, which is the purpose behind HFT in silver.

What impact, if any, has the arrival of silver ETFs had on the silver price, manipulated or otherwise?

A giant impact. The introduction of the big silver ETF in 2006 is probably the single biggest reason behind the climb in silver prices from the $7 area the year before. Investors have purchased close to 600 million ounces of silver in all the silver ETFs over the past six years. Without that buying, I doubt we would have made it over the $10 mark. While silver is still manipulated due to the concentrated short position on the COMEX, the introduction and success of the various silver ETFs has impacted the price tremendously. That should continue.

Eric Sprott has indicated that 143 times the amount of silver is traded in the paper markets versus mine supply. What implications does this have for facilitating silver price manipulation?

There are two distinct forces exerting artificial control of the price of silver. One is the concentration on the short side of the COMEX. The other is the ascension of the mindless and destructive computer trading of HFT. This was behind the "flash crash" in the stock market on May 6, 2010.

The difference in HFT is how the regulators react to it. When it occurred in the stock market, the regulators, the SEC and CFTC, rushed to make sure such meltdowns didn't recur in the stock market. Instead, the HFT practitioners were given free rein to disrupt the silver market. All the big sell-offs in silver are related to HFT to aid those holding large short positions.

The simple and undeniable fact is that the commercials are always big buyers whenever gold and silver sell off sharply. These commercials trick others into selling after prices have been deliberately pushed lower. Because the commercials are always the big buyers on every big sell-off, that proves they are rigging the price, as it is not possible for them to always be the buyers on these pre-arranged sell-offs.

What, if any, reasons can you think of that would explain why so much more paper silver is traded than physical silver?

Investors who hold physical silver don't buy and sell often; they hold. Only paper silver holders, because they only put up a fraction of the full value as margin, can be regularly tricked into selling their paper contracts on price declines. The big commercial shorts know this and that's what the game is all about - taking paper long traders to the cleaners.

Also, there is more paper traded than real silver because there is a very limited amount of real silver and an infinite supply of paper silver. It's important to know the difference and that difference is what makes physical silver superior to any paper alternative.

If one day large numbers of silver futures contract holders choose to take physical delivery, would that overwhelm the physical market? Who would be the party/parties on the hook at that point, and could they default, or how could this be resolved if there's insufficient physical silver to fill those contracts? What do you think that would do to the silver price?

Absolutely, large demands for physical delivery could overwhelm any market, including silver. The key is who would be demanding delivery. If it was a large single entity, then I suppose the regulators could cry foul and claim an attempt to manipulate prices higher. It would be much better if things continued as they have to date, where great numbers of smaller investors grab a piece of the physical silver market.

The shorts would be on the hook in that event and there is a risk, but not a guarantee, of a default. Default or not, if there is insufficient silver to meet demand, then the price must explode to cool off demand and bring sellers into the market. That's the way the law of supply and demand works.

I've read more suspicious activity just recently took place, on February 29th, in the silver futures market. My understanding is that large commercial traders, using high-frequency trading, manage to influence the price to their advantage. Can you explain what's really going on?

You've described it perfectly. The key ingredient, which many people miss, is that the large commercial traders don't sell heavily on such big down days. They just pretend to sell, by rigging prices sharply lower in order to scare and induce others into selling, in order for the commercials to buy. Everyone thinks the commercials are selling on these big down days, but in reality they are buying every contract they can trick others into selling. That's at the heart of this scam.

The proof of this is in government data, specifically the Commitment of Traders Report (COT), published by the CFTC weekly. These reports show that on every big down move, the commercials are always the big net buyers. This provides the reason and rationale for the sell-offs, namely, they are pre-planned events intended to allow the commercials the opportunity of buying whatever they can trick others into selling. If there's another reason that fits the documented facts, I haven't heard it.

The CFTC is aware of the concentrated positions in the silver market, thanks in large part to your efforts to point out the problems and irregularities. Commissioner Bart Chilton has made a number of statements acknowledging undue influence on the silver price by a small number of players. There is a lawsuit pending against JPMorgan in this matter. All of this has been going on for years, with no resolution. What's your best guess as to why that is?

I've narrowed it down to either the government is allowing and encouraging JPMorgan to manipulate the market, which the majority who write to me claim, or the CFTC is not able to take JPMorgan to task for some reason other than complicity. I think the CFTC is afraid of JPMorgan on a legal and insufficient resource basis. I recently wrote an article asking if JPMorgan was stupid for being so heavily short silver, although I don't think so. I think JPMorgan is just as much trapped in this big short position and is desperate.

The bottom line is that the motivation for why JPMorgan is so heavily short and why the CFTC is not moving against it is less important than the fact that the concentrated short position actually exists. Concentration is tantamount to manipulation. The CFTC has never brought a case of manipulation without a concentration existing. Why the CFTC doesn't apply the same measurement in silver is something they refuse to answer, even though they have been asked thousands of times.

What's your long-term outlook on the price of silver, and what events or milestones would help it along? What advice do you have for investors regarding silver?

MORE

Paper Trading and Manipulation in Precious Metals

By: The Dollar Vigilante | Mon, Mar 19, 2012

Forget about "Give me a break", it seems like you can't even buy a break with precious metals this past week. The metals still trended down as I suspected they would and even went a little lower than my down side possibility with gold. The recent activity around precious metals and the quick draw down days where the metals get hit hard does reek of manipulation and intervention. I have been asked many times in the past about manipulation in precious metals and the price action we see around key price levels. I feel most markets are manipulated in one way or another and precious metals are no different.

In fact silver is probably the most manipulated market in the world, I really can't think of any other market that is so easily manipulated. In a market that has approximately 30 million ounces of silver in warehouses available for delivery, there are days such as February 29 where you can have 255M traded in hours (the total for the day was estimated at over 500M oz traded). Such a concentration of positions by a few key players can and will move price to a key level, at which point computer trading can further extend the move which is what most likely happened on February 29th of this year. Here is some information and perspective on how much silver was sold in the paper market during that one day:

One Comex contract for silver is for 5000 ounces.

Average inventory of silver available for delivery is 30M ounces.

Silver production for the year is about 800M ounces a year.

Supposedly more than 45 thousand contracts traded on Feb 29 or about 255 M ounces.

In a matter of hours, paper silver sold 8.5 times more than inventory for available for sale.

So do I believe that the silver market is manipulated?

When you have such a concentration of selling on one side by a few sources, unlimited amounts of funds and knowledge of sell trigger points, any market could easily be manipulated. On that day alone, you had paper pushers selling almost one third of a year's production in a matter of hours. This selling was done by a few commercial firms that are known to have the highest short concentrated position of any market. Common sense tells me price manipulation is possible when you can sell endless amounts of paper silver in a matter of hours. A Price drop of several dollars is easily achievable once stop loss triggers get taken out to the downside. When you have a paper market which has no real bearing on the physical market or accountability for delivery, then anything is possible in terms of price.

So my answer is YES, the silver market can easily be manipulated and most likely is, unfortunately there is no way that we can prove it.

I am not the only one to think so; you may want to listen to some great audio interviews on Financial Sense about silver manipulation. Jim Puplava interviews Ted Butler, David Morgan and Eric Sprott about their views regarding the silver market manipulation and getting their response to CFTC's Commissioner Bart Chilton's take on the silver market. Even a commissioner from the CFTC believes that manipulation is possible, but no one is doing anything about regulating position limits in the silver market. It seems like the concentration of silver shorts by a few commercials will be overlooked again and the regulators will not get involved in enforcing the rules on position limits by the shorts. So if there was manipulation, the regulators are not doing their job in creating an equal and transparent market, they are allowing the manipulation to happen.

Here's the irony I find in the whole situation about manipulation and involvement by regulators. They are currently overlooking this manipulation in the silver market as long as it's on the short side and is done by their paymasters, the bankers. Back in the 1970's, the Hunt brothers wanted to protect their wealth and decided to take delivery of as much silver (real money) as possible. At the time, the regulators decided that the brothers were manipulating the silver market to the upside and forced them out of their long side contracts which stood for delivery by changing the rules and not allowing delivery of the physical. Here is a great video on YouTube called SBSS 15 The Real Hunt Story Part 1, which tells the story on why the Hunt brothers wanted to protect their wealth using silver. Now that the silver manipulation is on the short side by bankers and government, everything is overlooked and will not be regulated. Unfortunately this is the market we are dealing with so when it comes to paper silver trading, the paper pushers will get their way and always profit at someone else's loss.

Taking a look at the one year silver chart below, you can clearly see the big draw down days come very quickly. It takes a while for price to build a base and move higher, usually a few weeks to several months before we see significant price advances. Price drops seem to come very quickly at key price intervals, only taking days to give back most of the price gains which took months to advance.

If you are going to play the paper game with the big boys, there are a few things you should remember. First, you are playing their rigged game at their casino so do not get disappointed when they pick your pockets. Even if you do win big, they will only pay out in worthless paper dollars unless you specifically ask for delivery of the physical metals. Good luck in trying to take physical delivery of all your contracts like the Hunt Brothers tried to do in 1980. You will most likely end up like they did, forced out of your position with no silver in hand. Remember, you are up against a banking cartel with a legal monopoly on the printing press and the regulators in their back pocket.

But manipulation can only go on for so long; eventually the physical market will take control over the paper market. As new markets and exchanges open that deal only in physical commodities, we should see money flow out of rigged paper markets. There are many new exchanges opening up around the world and many of them offer contracts that actually stand for delivery (spot or futures pricing). Eventually these exchanges and bullion dealers will create the necessary arbitrage in physical metals against the paper market, which will then resemble the real price of silver. My suggestion to investors is to close down your paper accounts with the Comex and move to physical purchases paid for by cash and no leverage. Regardless of the price, at least you still have the physical and not just paper promises to pay you in another form of paper while they change the rules.

MORE

Eric Sprott and David Morgan Respond to CFTC Commissioner Bart Chilton on Silver Manipulation

Silver industry experts Eric Sprott and David Morgan take on the silver manipulation controversy

03/17/2012

http://www.netcastdaily.com/broadcast/fsn2012-0317-3.mp3

Ted Butler: How the Silver Manipulation Scheme Works - Ted Butler responds to CFTC Commissioner Bart Chilton

03/17/2012

http://www.netcastdaily.com/broadcast/fsn2012-0317-2.mp3

Bart Chilton's comments regarding commodities manipulation in an interview with FoxBusiness

March 2012

JP Morgan Whistleblower States JP Morgan Manipulates Silver & Gold Futures

3/14/2012

From: Z A N

Organization(s):

JPMorgan Chase

Comment No: 57019

Date: 3/14/2012

Comment Text:

Dear CFTC Staff,

Hello, I am a current JPMorgan Chase employee. This is an open letter to all commissioners and regulators. I am emailing you today b/c I know of insider information that will be damning at best for JPMorgan Chase. I have decided to play the role of whistleblower b/c I no longer have faith and belief that what we are doing for society is bringing value to people. I am now under the opinion that we are actually putting hard working Americans unaware of what lays ahead at extreme market risk. This risk is unnecessary and will lead to wide-scale market collapse if not handled properly. With the release of Mr. Smith’s open letter to Goldman, I too would like to set the record straight for JPM as well. I have seen the disruptive behavior of superiors and no longer can say that I look up to employees at the ED/MD level here at JPM. Their smug exuberance and arrogance permeates the air just as pungently as rotting vegetables. They all know too well of the backdoor crony connections they share intimately with elected officials and with other institutions. It is apparent in everything they do, from the meager attempts to manipulate LIBOR, therefore controlling how almost all derivatives are priced to the inherit and fraudulent commodities manipulation. They too may have one day stood for something in the past in the client-employee relationship. Does anyone in today’s market really care about the protection of their client? From the ruthless and scandalous treatment of MF Global client asset funds to the excessive bonuses paid by companies with burgeoning liabilities. Yes, we at JPMorgan that are in the know are fearful of a cascading credit event being triggered in Greece as they have hidden derivatives in excess of $1 Trillion USD. We at JPMorgan own enough of these through counterparty risk and outright prop trading that our entire IB EDG space could be annihilated within a few short days. The last ten years has been market by inflexion point after inflexion point with the most notable coming in 2008 after the acquisition of Bear.

I wish to remain anonymous as of now as fear of termination mounts from what I am about to reveal. Robert Gottlieb is not my real name; however he is a trader that is involved in a lawsuit for manipulative trading while working with JPMorgan Chase. He was acquired during our Bear Stearns acquisition and is known to be the notorious person shorting in the silver future market from his trading space, along with Blythe Masters, his IB Global boss. However, with that said, we are manipulating the silver futures market and playing a smaller (but still massively manipulative) role in manipulating the gold futures market. We have a little over a 25% (give or take a percentage) position in the short market for silver futures and by your definition this denotes a larger position than for speculative purposes or for hedging and is beyond the line of manipulation.

On a side note, I do not work directly with accounts that would have been directly impacted by the MF Global fiasco but I have heard through other colleagues that we have involvement in the hiding of client assets from MF Global. This is another fraudulent effort on our part and constitutes theft. I urge you to forward that part of the investigation on to the respective authorities.

There is something else that you may find strange. During month-end December, we were all told by our managers that this was going to be a dismal year in terms of earnings and that we should not expect any bonuses or pay raises. Then come mid-late January it is made known that everyone received a pay raise and/or bonus, which is interesting b/c just a few weeks ago we were told that this was not likely and expected to be paid nothing in addition to base salary. January is right around the time we started increasing our short positions quite significantly again and this most recent crash in gold and silver during Bernanke's speech on February 29th is of notable importance, as we along with 4 other major institutions, orchestrated the violent $100 drop in Gold and subsequent drops in silver.

As regulators of the free people of this country, I ask you to uphold the most important job in the world right now. That job is judge and overseer of all that is justice in the most sensitive of commodity markets. There are many middle-income people that invest in the physical assets of silver, gold, as well as mining stocks that are being financially impacted in a negative way b/c of our unscrupulous shorts in the precious metals commodity sector. If you read the COT with intent you will find that commercials (even though we have no business being in the commercial sector, which should be reserved for companies that truly produce the metal) are net short by a long shot in not only silver, but gold.

It is rather surprising that what should be well known liabilities on our balance sheet have not erupted into wider scale scrutinization. I call all honest and courageous JPMorgan employees to step up and fight the cronyism and wide-scale manipulation by reporting the truth. We are only helping reality come to light therefore allowing a real valuation of our banking industry which will give investors a chance to properly adjust without being totally wiped out. I will be contacting a lawyer shortly about this matter, as I believe no other whistleblower at JPMorgan has come forward yet. Our deepest secrets lie within the hands of honest employees and can be revealed through honest regulators that are willing to take a look inside one of America's best kept secrets. Please do not allow this to turn into another Enron.

Kind Regards,

-The 1st Whistleblower of Many

MORE - CFTC

MORE - Silverdoctors

Eric Sprott - What Happened in Gold & Silver is Stunning

03 March 2012

Today billionaire Eric Sprott told King World News that a staggering 500 million ounces of paper silver traded hands during the takedown in the metals this week. Eric Sprott, Chairman of Sprott Asset Management, had this to say about what took place the day of the plunge in gold and silver: “I can only imagine it’s the same forces that for the last twelve years have been at work in the gold market, trying to keep the volatility very large on the downside. As you are aware, we hardly ever get days when you get an intraday $100 rise in gold. When we look back at what happened (on Wednesday) we saw huge sell orders in gold and silver.”

Eric Sprott continues:

“When I look at the silver market in particular, in a 30 minute span we had sellers of 225 million equivalent paper ounces, in a market that in one year the silver miners only produce 800 million ounces. So again, it’s the paper markets overwhelming the physical market. It’s stunning to me that on a day like Feb. 29th we traded 500 million ounces of silver.

MORE

Whistleblower Maguire - US Entity Interferes in Gold Market

02 March 2012

This morning, in an exclusive interview, London whistleblower Andrew Maguire told King World News that the launch of a physical gold and silver exchange in China was interfered with and subsequently killed by a New York based entity with very powerful Chinese connections. Maguire also said Wednesday’s smash in gold and silver was blatant maniuplation. Here is what Maguire had to say about the situation: “Well, Eric, it couldn’t have been more blatant (intervention in the gold market) could it? Talk about not worrying about hiding your footprints. This was obviously sanctioned somewhere at a higher level because the amounts of contracts, paper contracts that hit the market, all at once, within seconds of each other, this was not normal trading.”

Andrew Maguire continues:

“This (manipulation) was 100% to protect resistance levels that were about to be breached. However, I don’t think for a minute this has fooled anybody. Anyone in the physical market was waiting for something like this. You only have to have enough of the weak money in there and sure enough they will flush it out.

READ MORE

LISTEN TO ANDREW MAGUIRE ON KING WORLD NEWS (click the icon on the bottom left)

Silver Update 3/1/12 Bullion Banks

01 Mars 2012

Cartel Dumps 102.5 Million Ounces of Paper Silver in 7 Minutes, Yet RAID FAILS!

Saturday, February 25, 2012

UPDATED

If you happen to need to take a trip to an NYC ER room tonight and experience an extraordinarily long wait, The Doc's about to explain why.

If you happen to need to take a trip to an NYC ER room tonight and experience an extraordinarily long wait, The Doc's about to explain why. Silver has put in a monster rally this week, and much to the cartel's dismay, was preparing to close the week above $35.50 today, preparing a break-out next week that could potentially fill the gap from the September smash to $40, and see silver off to the races back to challenge the all-time nominal highs near $50. Obviously, the cartel stepped in with a massive paper raid to prevent such a bullish weekly close.

That's where things got interesting and likely induced more than a few Myocardial Infarctions today among JPMorgan execs.

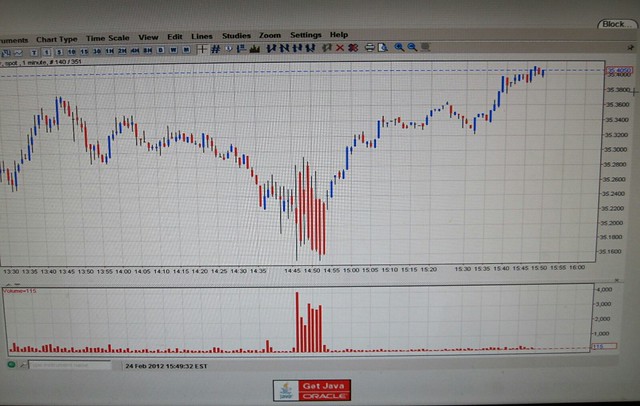

Notice the massive volume that began at approximately 14:47, with 4,000 paper contracts dumped on the market in a single minute, followed by 2,500, 1,800, 3,200, 3,000, 2,900, and 3,100 over the next 6 minutes.

Have a look for yourself:

MORE

Silver Update 2/24/12 Silver Salvage

February 24 2012

Starting about 14 min into the video:

Concentration Of Traders In The CFTC COTs

21 February 2012

Days of World Production To Cover Short Contracts

February 16, 2012 - 4:47pm

In December, I made public an article discussing the short position in the big silver ETF, SLV. At that time, the short position in SLV shares was in excess of 25 million shares and would run up to 26.6 million shares by mid-January. I hold that the shorting of shares in SLV is both fraudulent to shareholders of SLV and is manipulative to the price of silver. That’s because shorted shares of SLV do not result in physical silver being deposited into the Trust and leave the Trust, effectively, with shares not backed by metal to the extent of the short interest. (There is supposed to be one ounce of silver deposited for every share issued according to the prospectus and short selling circumvents that requirement.) Because physical silver is not bought and deposited on shorted SLV shares, the normal price impact of more demand on the physical silver market is also circumvented. That constitutes price manipulation. http://www.silverseek.com/commentary/slv-short-position-update

As a result of many of you writing to the sponsor of SLV, BlackRock, there were a number of consequences. For one, as previously mentioned to subscribers, within days of the publication of the article, lawyers representing BlackRock demanded, in no uncertain terms, that I cease what they claimed was defamation of their client and my publication of email addresses of top officers. More importantly, another consequence may have revealed itself late last week with the release of short interest data as of Jan 31. The new report indicated that the short position in SLV plunged by more than 35%, or by more than 9.4 million shares, from 26.6 million to under 17.2 million. This is the lowest level of shares held short in SLV in almost a year. The number of shorted shares in SLV is still too high, at over 5.3% of all outstanding shares issued, but at its peak last spring, the shorted shares represented more than 12% of total shares outstanding. http://www.shortsqueeze.com/?symbol=slv&submit=Short+Quote%99

The timeline on all this suggests that the most plausible explanation, at this point, is that BlackRock or someone in position to influence the SLV shorts to reduce their short position, did exert such influence. The sudden reduction in the short position came as prices were rising strongly, something not witnessed previously and also suggestive of an outside influence. Certainly, big future increases in the SLV short position will negate the explanation that BlackRock saw the merits of the allegations against the shorting of SLV and moved to curtail it. For now, however, it looks like the short covering in shares of SLV is as it appears, namely, as a result of the matter being brought to BlackRock’s attention and them acting on it. Thanks to all who took the time to write in.

Potentially, this could be a big deal in silver. Unlimited shorting in hard metal ETFs can have a very negative influence on the price of silver. At two previous significant tops in the silver price, in 2008 and 2011, the short position in SLV was at record high levels. I believe these record short positions in SLV were a strong influence in the price of silver breaking badly on both occasions. Eliminating and then preventing excessive short positions in SLV in the future will eliminate the incentive of large short sellers to rig prices lower and insure that SLV shares are issued in accordance with the terms of the prospectus and have real metal backing.

CFTC: Flawed Silver Investigations and Breaking The Law

February 16, 2012

OPEN LETTER TO THE CFTC

Commodities Futures Trading Commission

3 Lafayette Center

1155 21st St. NW Washington, DC 50581

Re: Flawed Investigations and Breaking The Law

Dear Commissioners:

For over 2 decades a large group of silver investors have been yelling and screaming at the CFTC to stop the rampant downward manipulation of the COMEX silver market. On May 14, 2004 the CFTC released the results of their 1st investigation by Michael Gorham, Director of Market Oversight, saying they have not found any evidence of silver market manipulation.

http://www.cpmgroup.com/free_library1/COUNTER-ARGUMENTS_TO_SILVER_CONSPIRACY_THEORIES/CFTC_Silver_Letter_May_2004.pdf

Dr. Gorham, who once worked at the Federal Reserve Bank, resigned only 3 weeks after releasing this report:

http://www.cftc.gov/opa/press04/opa4935-04.htm

As a truly REMARKABLE twist of fate, or not, Mr. Gorham now serves on the Probable Cause and Business Conduct Committees of the CME who were supposed to be overseeing MF Global before it imploded:

http://www.marketswiki.com/mwiki/Michael_Gorham

Then in May 2008 the CFTC released another report on the same topic again stating again that the silver market was not being manipulated. This time the CFTC decided NOT to put anyone's name on the report:

http://www.cftc.gov/ucm/groups/public/@newsroom/documents/file/silverfuturesmarketreport0508.pdf

This report piggy backed off the 2004 report in reinforcing the main argument why there was no manipulation in the silver market...

"Staff in 2004 also examined the relationship between NYMEX silver futures prices and cash market silver prices to determine whether NYMEX prices appeared to be unusually or significantly out of line with cash prices."

"NYMEX silver futures prices tend to track closely the price of physical silver...This analysis shows that there is not a downward bias in the NYMEX futures price vis-a-vis the LBMA price, which, as noted, is widely regarded as the benchmark value in the marketplace."

In BOTH reports the CFTC cites the "cash prices" as the prices for silver on the London Bullion Market(LBMA). It is absolutely important that the NYMEX (COMEX) prices stay in line with the "cash prices" of silver otherwise it would prove that the futures and options trading was SETTING the price for physical silver which is illegal. The PROBLEM with the CFTC's analysis is that they are comparing the NYMEX prices to a massively flawed proxy for the price of physical silver.

I'd like to direct your attention to the CFTC hearing on the silver market manipulation issue. Jeffery Christian of the CPM Group points out clearly that the LBMA really has NOTHING TO DO WITH THE "PHYSICAL MARKET" IN SILVER.

http://www.bullionbullscanada.com/index.php?option=com_community&view=videos&task=video&userid=330&videoid=43&Itemid=114

MORE

Blatant Suppression Of Silver Prices

By Patrick A Heller on February 15, 2012 3:04 PM

By Patrick A. Heller – Liberty Coin Service

Commentary on Precious Metals Prepared for CoinWeek.com

One tactic used by the US government, its trading partners, and allies in its effort to hold down the price of gold is to also manipulate the price of silver. Most of the time, gold and silver prices move in the same direction. Therefore, it the price of silver can be suppressed, that will influence investors and traders into expecting lower gold prices.

On January 17, the spot price of silver closed on the COMEX at $30.11. Yesterday, it closed at $33.70, an increase of 11.9%! Most people would take that as a sign of a strong silver market. However, the silver market is really much stronger than that relative price change.

In the COMEX weekly Commitment of Traders Report as of January 17 (which was reported on January 20), Commercial traders had a net short position on the COMEX of 20,382 contracts. At 5,000 ounces per contract, that means that Commercial traders, which are primarily the bullion banks who are trading partners of the US government, had a short position of 101,910,000 ounces on January 17.

In the COMEX weekly Commitment of Traders Report as of January 17 (which was reported on January 20), Commercial traders had a net short position on the COMEX of 20,382 contracts. At 5,000 ounces per contract, that means that Commercial traders, which are primarily the bullion banks who are trading partners of the US government, had a short position of 101,910,000 ounces on January 17.In the Commitment of Traders Report as of February 7, which was released on February 10, the Commercial traders net short position had increased by 14,268 contracts from January 17. As of February 7, the Commercial traders were net short 34,650 contracts, or 173,250,000 ounces!

In other words, the Commercial traders shorted the market by 71,340,000 ounces of silver on the COMEX from January 17 to February 7, increasing their net short position by 70%! The 71 million ounce increase in the short silver position is equal to about 10% of annual worldwide new silver mining supplies!

Normally, the selling of 71 million ounces of silver in a period of three weeks would cause the price of silver to plummet! How much higher would the price of silver have jumped January 17 if this increase of “paper silver” supply had never occurred?

But this short selling wasn’t the only recent blatant tactic to suppress silver prices. At the beginning of February, 1- and 2-month silver lease rates turned negative. Over this past weekend, 3-month silver lease rates turned negative. So, not only do borrowers of silver not have to pay any interest to do so, they will actually be paid a fee by the lender. Obviously, lenders are not making a profit when lease rates are negative. Negative lease rates send a signal to the market that there is so much of the physical commodity available that it should be worth less than its current price level. Therefore, the price of silver should have been declining in the past two weeks rather than treading water.

Last Friday, the COMEX dropped margin requirements on all the commodities it trades. The margin requirements for gold and silver futures contracts were decreased by 11% to 13%. Usually, when it is easier for investors to borrow money to purchase an investment, that tends to lead to greater demand followed by higher prices. Several people have contacted me to ask about the implications of lower margin requirements for leveraged gold and silver COMEX trading.

I have three thoughts about the decrease in the COMEX gold and silver margin requirements. First, the decrease affected all commodities traded on the COMEX. In the circumstances, it would have looked strange for all margin requirements to be decreased except for gold and silver. It could have resulted in more investors realizing that gold and silver prices were being suppressed.

Second, even though gold and silver margin requirements were reduced last week, they are still far higher than they were a year ago. In effect, the COMEX should have reduced gold and silver margin requirements before last week, and reduced them by an even a greater percentage than happened.

Third, one way that market manipulators can make a profit is by temporarily suppressing prices even though the long-term trend is for higher prices. The Commercial traders can sell a lot of paper contracts to drive down the price, shaking out weak hands investors, then cover those new short positions after prices have fallen. A decline in margin requirements could entice some weak hands investors to enter the gold and silver market just before a major price drop, thereby increasing profits earned by the Commercial traders.

MORE

Enough is Enough

Theodore Butler

The journey to justice and truth is often long and arduous, but must never be abandoned. The alternative is to live a life lacking substance. But neither should the journey be unnecessarily prolonged. These things tend to creep up on you day by day, but we have passed the point of the CFTC taking too long for deciding if the silver market has been manipulated in price. Enough time has passed.

Having started in August 2008, we are now at the 3.5 year mark in the current investigation into silver by the Enforcement Division of the Commodity Futures Trading Commission (CFTC). Never has a similar investigation taken this long. Considering that the current silver investigation is the third such inquiry by the Commission into alleged downside price manipulation by large commercial participants on the COMEX, the agency has spent most of the past decade investigating silver. As recently as this past November, the Commission reaffirmed that the silver investigation is ongoing. Still, the issue is unresolved.

http://www.cftc.gov/PressRoom/PressReleases/silvermarketstatement

The current silver investigation began due to revelations I discovered and wrote about in the CFTC’s Bank Participation Report of August 2008. This report indicated one or two US commercial banks held a concentrated short position which was unprecedented and uneconomic in terms of real world supply and demand. I asked the question – how can one or two US banks holding a short position equal to 25% of annual world production not be manipulative? That question has not been answered by the Commission to this day. Later, I discovered that it was basically only one US bank, JPMorgan, which was the big COMEX silver short. http://news.silverseek.com/TedButler/1226344970.php

Not for a moment do I believe that the CFTC initiated the current silver investigation (or the previous two) just because I wrote a few articles. The key was that so many readers took it upon themselves to write to the Commission and their elected officials about the issues of concentration and manipulation in the silver market. Simply put, there would have been no silver investigations had not great numbers of you petitioned the regulators. Please think about that for a moment. It is beyond extraordinary that the agency has investigated and continues to investigate such a small market like silver. That can only be because of public pressure and that the evidence was compelling. Most remarkable of all is that the core allegation in all three silver investigations has remained the same – manipulative short selling by large commercial interests on the COMEX.

MORE

The Three Elements Of Manipulation Ted Butler Commentary January 9, 2012 This is an excerpt from the Weekly Review for subscribers of January 7 - Finally, Commissioner Bart Chilton of the CFTC gave an interview this week with Jim Puplava that should interest you. Click here to read A number of subscribers asked me if I would comment on what Commissioner Chilton had to say. In commenting, I can’t help but try to be as objective as possible. For the record, I commend Chilton for the role he has taken on the important issues, like position limits, concentration and in addressing allegations of manipulation in silver. He is the only commissioner to have done so. I believe there would be no ongoing silver investigation were it not for him. I think he is one of the good guys and I started writing to him about these issues in 2007 http://www.investmentrarities.com/ted_butler_comentary/11-13-07.html I agree with most of what Commissioner Chilton had to say, particularly about concentration and position limits and manipulation. I’m glad the interview was mostly about potential manipulation in the silver market. I’m going to skip over all the things I agree with Chilton on and confine my remarks to where I disagree with him. Agreement can be boring. Even though the disagreements are few, I believe they go to the heart of the matter. Chilton pointed out that it is difficult to prove manipulation in a court of law. He indicated that there are three elements necessary to prove manipulation – the intent to manipulate, the ability to manipulate and the success in the manipulation. I accept his legal definition. Where I respectfully disagree with him is in the degree of difficulty in establishing all three elements in the silver manipulation. Let’s go through the three elements. Let’s forget for a moment that silver has been under investigation by the CFTC’s Enforcement Division for almost three and a half years and that countless civil lawsuits have been filed against JPMorgan for allegations of silver manipulation in 2008. Let’s just focus on the last year, when silver experienced two separate 35% price declines in a matter of days. Such a decline in a world commodity for no observable supply/demand reason is unprecedented and I would say impossible in a free market. Yet it happened twice in silver within months. MORE Anatomy of Silver Manipulation - How Low Can It Go? Avery Goodman May 9, 2011 As we warned our readers on May 1, 2011, when silver had clawed its way back to about $48 per ounce: “We expect another massive price attack in the next few days.” We came to this conclusion based upon a number of factors, including the impending opening of the Hong Kong Merchantile Exchange, which will be controlled by many of the same international players who control NYMEX. Like clockwork, a vicious attack, perhaps the most ferocious one ever mounted in the history of precious metals, began on Monday, May 2, 2011. We knew it was coming, but to be honest, we didn’t expect the level of ferocity. Following our own suggestions, when silver had tanked by about 18%, we entered into a small speculative long position, using the SIVR silver trust. The price punched right through the minor support level we had chosen, and continued down. Had we realized the depth of the silver short seller despair, we would have played the game a bit differently. We would have waited longer, bought a lot more later on, and created a much longer term position. As it is, we have lost nearly nothing, and will do it anyway. Nevertheless, as irrational as this kind of thinking is, and as much as we warn people against it, human beings are human beings and we are not happy about putting on a little bet, no matter how small, that fails to catch the bottom of a dip. The level of despair among short sellers, which is motivating this attack, is growing. Anything could happen at this point. They could give up entirely, or the attack could become more ferocious. We don't know. What we do know is that the short sellers' predicament has just grown worse. They will eventually become even more desperate than they are now as weeks and months pass by. We will explain why shortly. New and ever larger performance bond deposit requirements are being announced by the NYMEX so-called "clearing house risk committee" (performance bond committee) almost every other day. On top of these substantial increases, the individual clearing members are often making even bigger demands and hiking up performance bond requirements even higher. We cannot help but wonder if some of these clearing members are themselves short silver, or if they are deathly afraid that other clearing members will default, leaving them footing the bill? Or are they trying to help attack their own customers? To the extent that a clearing member is raising performance bonds above the level of the exchange, customers should say goodbye and never do business with them again. According the official spokesperson for CME Group, which owns NYMEX, the performance bond increases are designed to address "increased risk". If this were so, however, such changes would apply only to short sellers and new long buyers who purchased up in the higher price ranges. Most of the older long buyers were sitting on huge profits from the upward movement of silver, when the new bond requirements were imposed in the $49 range. They posed no greater risk at all than they did back when they made their purchases at $18, $20, $25 per ounce, etc. But the exchange and its dealers don't play the game that way. Instead, they apply these changes to everyone, even people who may have bought when silver was down near $18 per ounce, even though these older position holders pose no greater risk of defaulting than before. The exchange committee members are quite expert at all this, and are well aware that the net effect of what they were doing would be to throw people involuntarily out of positions. The effect is carefully calculated and thought out, and is part of the overall process used to artificially control silver prices. Coupled with the sudden increased performance in bonds, there has been an all-out media effort to convince people that a “bubble is bursting” even though, as we will shortly explain, anyone who is worth his salt as an analyst knows it isn't true. There has NEVER been any bubble in silver in 2011, and therefore, it cannot possibly "burst”. There has simply been an unwinding of a grossly underpriced asset that has been subject to a multi-year price suppression effort. Be that as it may, this downturn provides, for the first time in a long time, more than mere gambling opportunities. Highly leveraged and undercapitalized speculators have been kicked out of their positions, and they had pushed the price of silver up very fast. It would have gone to the same levels, anyway, and beyond, but the process would have been slower and steadier if the market had been limited to cash buyers and well-capitalized investors. We have been carefully observing the methods used in this attack and have reached some conclusions. The attack is not sophisticated. It is NOT rocket science. The method is so simple that it is astounding that so few people see it for what it is. Regulators could put an end to it any time they want to. They simply don’t want to. That means, of course, that they are essentially complicit. There are genuine folks over at CFTC, like Commissioner Bart Chilton, but they are operating at an agency which is structurally corrupted, with a revolving door swapping employees to and from the regulator and those who are supposed to be regulated. The current price attack involves an overwhelming creation of transient short positions that last less than one day. This is expensive to do in terms of upfront cash. But it isn't quite as expensive as it may seem at first glance. Each day, except on Friday, May 6th, more than 10,000 short positions appeared to be transiently created, closed and recreated during the trading day. This must have required posting at least $180 million in performance bonds. However, to give credit to the ingenuity of the manipulators, most cash is recouped by the end of the trading day. With access to Federal Reserve loan windows, putting up an infinite amount of upfront fiat cash in the morning of a trading day is no deterrent. From what we can see, this is what they are doing, in a highly coordinated fashion: MORE Silver Price Manipulated, says RegulatorBy Dominique de Kevelioc de BailleulPosted by on November 5, 2011Just as the issue appeared to slip into the trash barrel, CFTC Commissioner Bart Chilton told readers ofKing World Newsthat he still believes the silver price has been manipulated at the Chicago Mercantile Exchange.“I believe there has been repeated attempts to influence prices in the silver market,” Chilton told KWN. “And there’s been fraudulent efforts to persuade and deviously control the price.” After years of pressure exerted onto the CFTC by the Gold Anti-Trust Action Committee (GATA) and silver market specialist Theodore Butler of Investment Rarities Inc., as well as public disclosure of the scheme from former Goldman Sachs trader, Andrew Maguire, the CFTC initiated an investigation against two banks that the regulatory agency suspected of participating in the scheme to suppress the price of silver, JP Morgan and HSBC. MORE | ||

Silver, Gorillas, Madoff and Financial Regulators –Will they ever learn?

By Ned Naylor-Leyland

September 2011

One of the most uncomfortable facts surrounding the Bernie Madoffcase was that he was allowed to continue operating for years despiteall the evidence about this fraud being gift-wrapped and delivered(on more than one occasion) by Harry Markopolous to the SEC.Despite the clear evidence handed to them, the SEC looked the otherway. Interestingly, and coincidentally, JPMorgan was a key player inthe Madoff case, and this summer the Trustee in charge of liquidatingMadoff’s firm sought $19bn in damages from JPMorgan, accusingthe bank of being ‘an active enabler fo the Madoff Ponzi scheme’. Itis also widely known that JPMorgan has repeatedly been accused ofmanipulating Silver (and Gold) prices, and in light of the recentdowndraft in Silver, I felt it would be pertinent to revisit the timelineand details of this ‘manipulation’ and the ‘investigation’ into it. Thereis an uncomfortable echo here with the Madoff case and it is alsoworth reiterating as background to this story that there is an ONGOING investigation at the CFTC into Silver manipulation.

MORE

JP Morgan Silver Squeeze

The desire to take down JP Morgan through the acquisition of silver originated with Max Keiser, but, it now has a life of its own. People have asked me what I think of the concept. My response is anything that persuades individuals to get out of Federal Reserve Notes and into silver or gold is a good thing. To bring down the Federal Reserve System we need to stop using their debt-laden dollars and establish our own private currency. Gold and silver have always worked in the past.

A more realistic approach is to keep all of our wealth and long-term savings in precious metals and deprive them of the opportunity to hyper-inflate it all away. That means long-term savings and investments. We can continue to use the dollar for our immediate needs, but we need to convert our long-term assets into precious metals or we will end up losing them. Period.

Now, back to JP Morgan:

"It is widely known that J.P. Morgan (NYSE: JPM) holds a giant short position in silver. Furthermore, some observers are accusing the bank of acting as an agent for the Federal Reserve in the market - every tick higher in the price of silver undermines confidence in the U.S. Dollar. A lower silver price helps keep the relative appeal of the U.S. dollar and other fiat currencies high." (Source)

In other words, it is in the Illuminati's best interests to suppress the price of silver. The general public knows that when silver prices are high, it is a major sign of inflation and a worthless dollar. This translates into a major depreciation in their dollar based investments through inflation.

"By selling massive amounts of paper silver in the futures market, JPM has been able to suppress the price of the precious metal. It is believed that these short positions are naked (i.e. they are not backed by any physical silver). In fact, reports indicate that JPM is short more paper silver than physically exists in the world" (Ibid)

For the unitiated, this is how the process works:

MORE

J.P. Morgan Getting Squeezed In Silver Market?

Scott Rubin

Sunday, December 5, 2010

By selling massive amounts of paper silver in the futures market, JPM has been able to suppress the price of the precious metal. It is believed that these short positions are naked (i.e. they are not backed by any physical silver). In fact, reports indicate that JPM is short more paper silver than physically exists in the world.

An article by Max Keiser which appeared in the Guardian on December 2, 2010 claims that the size of the short position is 3.3 billion ounces of silver.

In recent days, rumors have been swirling on the internet that JPM's massive short position is about to blow up in their face in the form of an almighty short squeeze and potential COMEX default as large traders demand physical delivery of silver that COMEX does not have in their vaults.

J.P. Morgan is currently under investigation by the CFTC for allegedly manipulating the price of silver. The investigation into the bank can be traced back to November 2009 when London metals trader and whistleblower Andrew Maguire contacted the CFTC to report market manipulation prior to it actually occurring.

Maguire had been told by J.P. Morgan commodity traders that the bank was manipulating the price of silver and subsequently reported this to the CFTC. He also gave the CFTC two days' notice about an impending silver manipulation that would take place around the Nonfarm payrolls number on February 5, 2010.

The manipulation played out EXACTLY as Maguire had predicted. You can find the emails between Maguire and Ramirez here. Shortly after this information came to light, the whistleblower was involved in a bizarre hit and run accident in London which caused him and his wife to be hospitalized.

Feds probing JPMorgan trades in silver pit

By MICHAEL GRAYLast Updated: 10:42 AM, May 16, 2010

Posted: 12:30 AM, May 9, 2010

Federal agents have launched parallel criminal and civil probes of JPMorgan Chase and its trading activity in the precious metals market, The Post has learned.

The probes are centering on whether or not JPMorgan, a top derivatives holder in precious metals, acted improperly to depress the price of silver, sources said.

The Commodities Futures Trade Commission is looking into civil charges, and the Department of Justice's Antitrust Division is handling the criminal probe, according to sources, who did not wish to be identified due to the sensitive nature of the information.

The probes are far-ranging, with federal officials looking into JPMorgan's precious metals trades on the London Bullion Market Association's (LBMA) exchange, which is a physical delivery market, and the New York Mercantile Exchange (Nymex) for future paper derivative trades.

JPMorgan increased its silver derivative holdings by $6.76 billion, or about 220 million ounces, during the last three months of 2009, according to the Office of Comptroller of the Currency.

Regulators are pulling trading tickets on JPMorgan's precious metals moves on all the exchanges as part of the probe, sources tell The Post.

JPMorgan has not been charged with any wrongdoing.

The DOJ and CFTC each declined to comment, as did JPMorgan.

The investigations stem from a story in The Post, which reported on a whistleblower questioning JPMorgan's involvement in suppressing the price of silver by "shorting" the precious metal around the release of news announcements that should have sent the price upwards.

MORE

Ted Butler on the Metals Market

Saturday, May 1, 2010

Ted is interviewed each week exclusively on KWN and is followed by many institutions including Sprott Assett Management. In this interview Ted stated, “More important and more serious than what's currently happening with Goldman Sachs, this is a crime in progress, this is an allegation of current market manipulation. This is as serious as you get, you don't get bigger than market manipulation.” Whistleblower Andrew Maguire credited Ted Butler as being the inspiration for coming forward to the CFTC with his complaint against JP Morgan’s alleged metals market manipulation Ted has researched the commodity markets actively for 3 decades. Ted is internationally well known for his writings on silver, gold, commodities and his COT (commitment of traders) report.

MORE (click the icon on the bottom left)

Metal$ are in the pitsTrader blows whistle on gold & silver price manipulation

By MICHAEL GRAY

Last Updated: 4:33 AM, April 11, 2010

Posted: 2:10 AM, April 11, 2010

There is no silver lining to the activities of JPMorgan Chase and HSBC in the precious-metals market here and in London, says a 40-year veteran of the metal pits.

The banks, which do the Federal Reserve's bidding in the metals markets, have long been the government's lead actors in keeping down the prices of gold and silver, according to a former Goldman Sachs trader working at the London Bullion Market Association.

Maguire was scheduled to testify last week before the Commodities Futures Trade Commission, which is looking into the activities of large banks in the metals market, but was knocked off the list at the last moment. So, he went public.

Maguire -- in an exclusive interview with The Post -- explained JPMorgan's role in the metals pits in both London and here, and how they can generate a profit either way the market moves.

"JPMorgan acts as an agent for the Federal Reserve; they act to halt the rise of gold and silver against the US dollar. JPMorgan is insulated from potential losses [on their short positions] by the Fed and/or the US taxpayer," Maguire said.

In the gold pits, Maguire sees HSBC betting against the precious metal's price without having any skin in the game in the form of a naked short.

"HSBC conducts an ongoing manipulative concentrated naked short position in gold. Silver is much easier to manipulate due to its much smaller [market] size," Maguire added.

"No one at JPMorgan is familiar with Andrew Maguire," said Brian Marchiony, a company spokesman. HSBC declined to comment.

Also during the CFTC hearing, Jeff Christian, founder of the commodities firm CPM Group, said that the LBMA, the physical delivery market for gold and silver in the UK, has been using leverage, which is another way to depress the price of gold and silver.

MORE

In the gold pits, Maguire sees HSBC betting against the precious metal's price without having any skin in the game in the form of a naked short.

"HSBC conducts an ongoing manipulative concentrated naked short position in gold. Silver is much easier to manipulate due to its much smaller [market] size," Maguire added.

"No one at JPMorgan is familiar with Andrew Maguire," said Brian Marchiony, a company spokesman. HSBC declined to comment.

Also during the CFTC hearing, Jeff Christian, founder of the commodities firm CPM Group, said that the LBMA, the physical delivery market for gold and silver in the UK, has been using leverage, which is another way to depress the price of gold and silver.

MORE

Harvey & Lenny Organ & Adrian Douglas

Wednesday, April 7, 2010

Harvey & Lenny Organ & Adrian Douglas: Drop Another Bombshell In What Could End Up Being The Largest Fraud In History - I was contacted again by Adrian Douglas, Board of Director for Gata with another stunning new bombshell involving the man he testified with at the CFTC meeting Harvey Organ. Harvey, who was invited by the CFTC to testify and his son Lenny describe an eyewitness account with another piece of the puzzle in what could turn out to be the largest fraud in history. This time a large international bank with almost 15 million customers in 50 countries around the world becomes part of this unfolding saga. It is so hard to believe and unimaginable so let’s continue our trip down the rabbit hole with another King World News exclusive interview.

MORE (click the icon on the bottom left)

Gold, Silver, The CFTC and Conspiracy Theories

Not being much of a conspiracy theorist, last week’s hearing by the CFTC (Commodities Futures Trading Commission) on futures market trading for metals was a subject of some interest to me, but the news flow since that time has been rather remarkable – if for no other reason that none of the news seems to be flowing in the mainstream media.

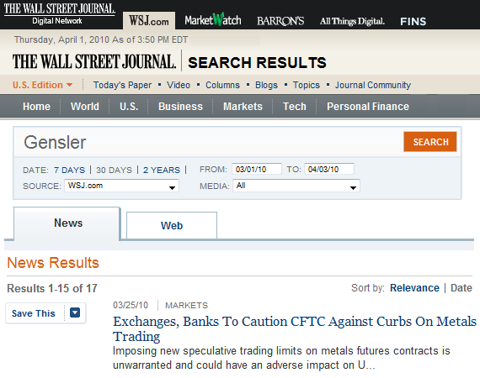

In fact, a search at the Wall Street Journal on “Gensler” (CFTC Chairman Gary Gensler would surely be included in any report) produces only this one item from before the hearing.

You’d think that, if a news organization that normally finds time to report on the most arcane of financial market goings-on saw fit to publish a story before the hearing was held, they’d also figure it was worthwhile to let their readers know what happened at the hearing.

Apparently not.

The one story that the search did turn up quickly gets to the heart of the argument against imposing position size limits for metals markets – the real question that the hearing was attempting to answer:

Later in the story they mention that GATA (Gold Anti-Trust Action Committee) chairman Bill Murphy was planning to speak though, curiously, they failed to mention him by name and then, even more curiously, they followed this mention up with almost three times as many words bashing those, like Murphy, who allege manipulation in these markets.

Imposing new speculative trading limits on metals futures contracts is unwarranted and could have an adverse impact on U.S. markets, some exchange and bank officials will tell the Commodity Futures Trading Commission Thursday.

MORE

One of the staunchest believers in the allegations of gold manipulation—the chairman of the Gold Anti-Trust Action Committee—will testify as well.

But others, including the CME’s Mr. LaSala and John J. Lothian, a commodity trading advisor, futures broker and the head of a well-known markets newsletter, will urge the CFTC not to pay attention to arguments that there has been manipulation.

“Those who believe gold and silver markets are manipulated to keep prices low are nothing more than politically opportunistic rent seekers in my book,” Mr. Lothian planned to say. “They are parasites on the body public profiting from selling fear and seeking political change that will benefit their world view and related market position.”

It's Ponzimonium in the Gold Market

Nathan Lewis.Fund manager, author of Gold: the Once and Future Money (2007)

Posted: March 31, 2010 10:13 AM

We've had a string of amazing revelations recently regarding the world's precious metals market. This is important stuff for anyone (like me) who holds gold as a means to avoid currency turmoil and counterparty risk.

(My earlier post on shenanigans at the Comex gold market.)

This news has been actively suppressed in the mainstream media.

The Commodity Futures Trading Commission, a U.S. government regulatory agency, held hearings in Washington D.C. in late March regarding position limits in the futures market.

People involved in the markets have known/suspected for years that they have been manipulated by certain large entities, notably JP Morgan and Goldman Sachs.

Analysts like silver maven, Ted Butler, hedge fund giant, Eric Sprott, and the Gold Anti-Trust Action Committee (GATA) have been collecting evidence of this manipulation for years.

These hearings were supposed to be a non-event. However, despite the media lock-down, the word is getting out.

The CFTC, like the SEC, is a conflicted agency. Some people, notably Chairman Gary Gensler and Commissioner Bart Chilton, seem to want to clean up the sleaze, fraud and corruption.

The CFTC even invited GATA's Bill Murphy and Adrian Douglas to make statements. Would you be surprised to learn that the cameras had a "technical malfunction" during Bill Murphy's statement, which magically righted itself immediately after he finished?

After the hearing, according to Douglas, Murphy was contacted by several major media outlets for more interviews. Within 24 hours, all the interviews were canceled. All of them.

You can follow the links above to see the research that Butler, Sprott and GATA have done over the years. That was only one part of the emerging story.

The second part is the appearance of London metals trader and now whistleblower Andrew Maguire, who understands JP Morgan's manipulation scheme inside and out.

Maguire understands the process so well that he was able to describe it to the CFTC's Bart Chilton on the phone in real time. As in: "in a few minutes, they are going to do this, and then they will do that."

Listen to an extended interview with Maguire and GATA's Adrian Douglas on King World News here.

Maguire has taken some personal risks to tell all this in public. In fact, almost immediately after his initial statements, he was run over by a car while walking down the street. The driver sped away, nearly running over some other pedestrians in his haste to escape. Fortunately, Maguire survived the hit-and-run "accident" with minor injuries. What a coincidence.

The third item was during the question-and-answer session at the CFTC hearings. GATA's Adrian Douglas.

MORE

Sophisticated attack disables King World News site for 2 hours

Submitted by cpowell on Thu, 2010-04-01 02:36. Section: Daily Dispatches

10:25p ET Wednesday, March 31, 2010

Dear Friend of GATA and Gold (and Silver):

Internet servers hosting the King World News Internet site, which today posted a half-hour interview with three GATA board members, were attacked and disabled tonight from approximately 8 to 10 p.m. ET.

The servers are maintained by one of the largest Internet site hosting companies in the world and one of its technicians told King World News proprietor Eric King, "We cannot figure out why this cluster of servers is being attacked." The King World News site host has maintained the site on a "grid" system of servers so that ordinary technical problems with any one server cannot disable the site, but tonight's attack was sophisticated and brought down the entire grid.

King and his family have not been attacked and one may suppose that what happened tonight at least is preferable to being rammed by a hit-and-run driver, as CFTC whistleblower Andrew Maguire and his wife were rammed in London the day after GATA disclosed at last week's hearing of the U.S. Commodity Futures Trading Commission that Maguire had given the commission detailed warning of a manipulation of the futures market and the commission had done nothing about it.

Dear Friend of GATA and Gold (and Silver):

Internet servers hosting the King World News Internet site, which today posted a half-hour interview with three GATA board members, were attacked and disabled tonight from approximately 8 to 10 p.m. ET.

The servers are maintained by one of the largest Internet site hosting companies in the world and one of its technicians told King World News proprietor Eric King, "We cannot figure out why this cluster of servers is being attacked." The King World News site host has maintained the site on a "grid" system of servers so that ordinary technical problems with any one server cannot disable the site, but tonight's attack was sophisticated and brought down the entire grid.

King and his family have not been attacked and one may suppose that what happened tonight at least is preferable to being rammed by a hit-and-run driver, as CFTC whistleblower Andrew Maguire and his wife were rammed in London the day after GATA disclosed at last week's hearing of the U.S. Commodity Futures Trading Commission that Maguire had given the commission detailed warning of a manipulation of the futures market and the commission had done nothing about it.

MORE

GATA - King World News

Wednesday, March 31, 2010